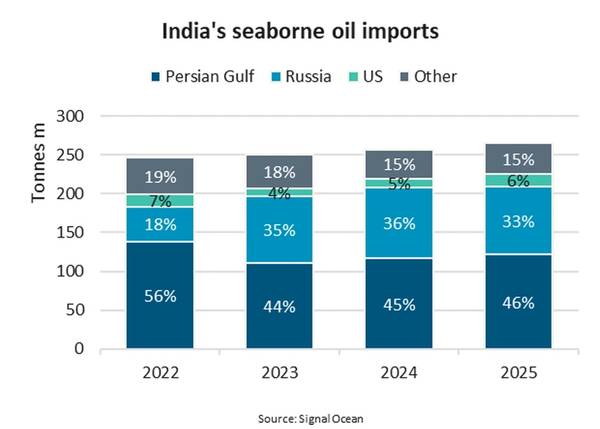

"In 2025, India’s oil imports from Russia made up 33% of the country’s total seaborne oil imports and 25% of Russia’s seaborne oil exports. A new trade agreement between the US and India could, according to US President Donald Trump, put an end to that trade,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.

On Monday, President Trump announced that a new trade agreement between the US and India would lead to mutual tariff reductions. US tariffs on Indian goods would fall from 50% to 18% and Indian tariffs on US goods could fall to zero. However, India’s Prime Minister, Narendra Modi, has yet to publicly confirm the Indian tariff reduction.

In addition, President Trump announced that the deal included Indian commitments to end oil purchases from Russia while significantly increasing purchases of US energy and goods. India has yet to confirm this part of the agreement.

“During the first five weeks of 2026, Russian oil exports to India have already fallen 34% year-on-year. The reduction could be due to the EU restrictions on purchase, import and transfer of oil products refined from Russian crude oil,” says Rasmussen.

While it is too early to conclude that the Russia-India oil trade will stop, the combination of EU restrictions and a US-India agreement could reduce the trade significantly.

Prior to Russia’s invasion of Ukraine, up to two thirds of India’s crude oil and oil product imports arrived from the Persian Gulf. In 2025, that had reduced to 45%. It appears likely that Indian importers could turn to imports from the Persian Gulf to replace any potential reductions in imports from Russia. President Trump has said India will be increasing its oil purchases from the US and possibly Venezuela.

In 2025, the Russia-India trade made up 0.5% and 4.7% of tonne miles in the clean and dirty tanker trades respectively. A reduction or an end to Russia-India volumes could have significant impact on especially the dirty tanker trade, not least as the mainstream fleet could see significant demand increase at the expense of the parallel fleet.

“While Trump in October last year said India had committed to significantly reduce its Russian oil purchases, we find this much more likely to happen now. We do not expect, however, that Russian oil exports will fall by the same amount as Russia will likely aim to find new buyers, even if it requires a higher rebate for Russian oil,” says Rasmussen.