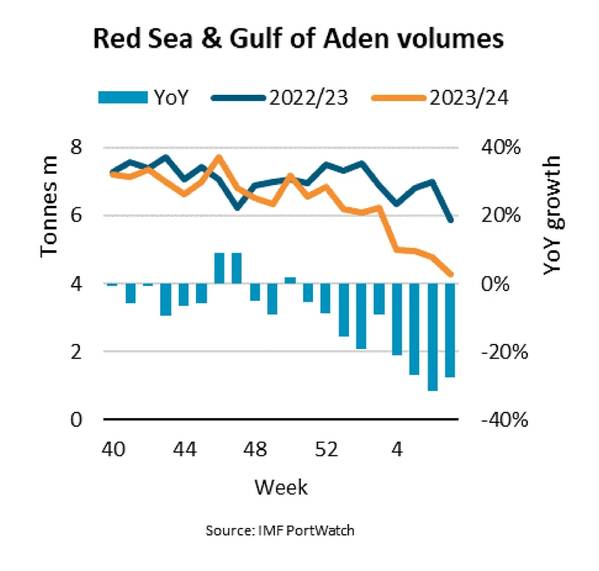

“During the first seven weeks of 2024, cargo volumes to and from ports in the Gulf of Aden and Red Sea declined 21% y/y. The number of ships arriving in these ports significantly declined as merchant shipping increasingly avoided transiting through the region due to concerns over attacks on ships by the Houthis,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.

Since November 2023, Houthi forces have attacked ships in the Red Sea and Gulf of Aden. In December, most container and gas carriers started avoiding the region and by January, a significant reduction in transits was seen across most sectors.

So far in February, the number of ships transiting through the Gulf of Aden and the Suez Canal is 50% and 37% lower than last year respectively. Container ship transits are down by 70% through the Gulf of Aden and the Suez Canal. Prior to the attacks, shipments through the Suez Canal accounted for roughly 10% of global trade.

“The attacks on ships in the Red Sea are directly affecting the ability of countries in the region to import and export cargo. Even where alternative export routes exist, these often come at a higher cost, longer duration and with constraints to capacity,” says Rasmussen.

Saudi Arabia, Jordan and Egypt can avoid the Red Sea, as Saudi Arabia and Jordan can transport cargo via for example Dammam in the Persian Gulf, while Egypt can rely on its Mediterranean ports such as Alexandria and Damietta. However, rerouting will be difficult for all but container cargoes.

Other countries do not appear to have viable alternatives to Red Sea shipping and any attempts to transport cargo overland would likely be very difficult. Consequently, shipments in Sudan, Somalia, Eritrea and Yemen have so far fallen 25% y/y in 2024. Djibouti is a noteworthy exception, where shipments have remained stable.

The worsening conditions could affect the economies and possibly add to instability in several economies in the region. Yemen, Sudan and Somalia already suffer under armed conflicts. The instability in the Red Sea has made it more challenging for them to receive international aid and could increase the cost of basic goods.

“A US-led coalition and a recently launched maritime operation by the EU have been deployed with the aim to safeguard ships in the Red Sea. However, the attacks have not yet ceased, and the outlook remains uncertain. Until a solution emerges, regional economies will continue to bear the cost,” says Rasmussen.