“During the first eight months of 2023, contracting of product tanker newbuilds hit a 10-year high, reaching 140 ships and 10.72 million deadweight tons (DWT). The last time more than 10 million DWT were contracted from January through August was in 2013,” said Niels Rasmussen, Chief Shipping Analyst at BIMCO.

Newbuild contracting activity during the past five years has been low at about 5.46 million DWT per year. In addition, the product tanker order book hit a low of 9.67 million DWT in December 2022, the smallest order book since June 2001.

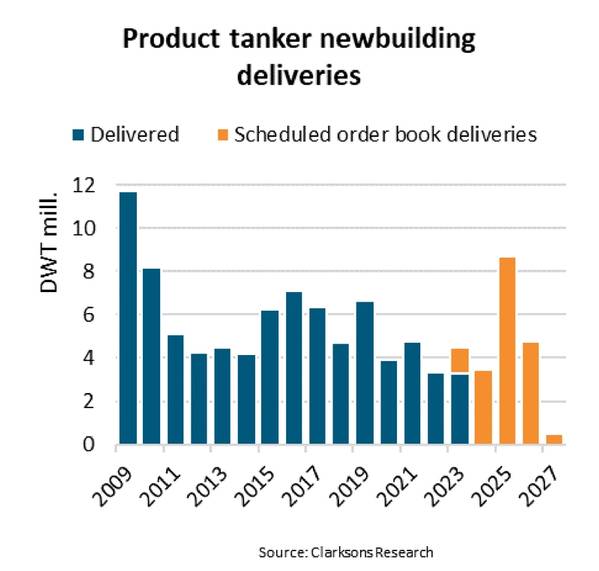

“Due to the low contracting of ships, the fleet has only grown at an average annual rate of 2.6% between 2018 and 2023. Deliveries from the current order book will remain low until 2025 when they are expected to exceed 8 million DWT for the first time since 2009,” said Rasmussen.

Deliveries may end higher as ships can still be contracted for 2025 delivery and beyond.

However, recycling of ships will temper future fleet growth although markets are expected to stay strong through at least 2024. This will incentivise owners to keep ships in operation for longer. In addition, the sanctions on Russian oil product exports by G7 countries appear to have created new trades where the older product tankers remain in demand.

Still, 9% of product tankers, equal to 11.65 million DWT and 6% of the total fleet, are currently more than twenty years old and are prime targets for recycling, not least due to the tightening greenhouse gas emission targets.

“Despite decarbonisation regulations, the share of ships in the order book that are planned to use some type of alternative fuel remains low. Only 16% of the ships and the DWT in the order book are currently expected to be prepared for the use of an alternative fuel,” says Rasmussen.

Decarbonization’s impact on the demand side must also be a consideration when planning the future fleet. According to estimates by the International Energy Agency, demand for transport fuels will peak in 2026, and though demand for petrochemical feedstock may continue to grow, the overall peak demand may still be within sight.

“Balancing the need for fleet renewal to meet future decarbonisation targets while considering the potential for waning demand due to decarbonisation remains a key challenge when planning new orders,” says Rasmussen.