There are questions whether the low oil price is benefiting South Africa. ICE Brent spot price is trading around $30, the lowest level in 12 years, seen in the context of market surplus. The December meeting in which OPEC failed to set a total production quota and the Chinese stock market turmoil is seen as a sign of increasing concern about China’s health.

While expectations of an oversupplied market in 2016 continue, some oil analysts predict an oil price per barrel under $20 in the coming months. The fall in the oil price has party been offset by the weaker rand / dollar exchange rate.

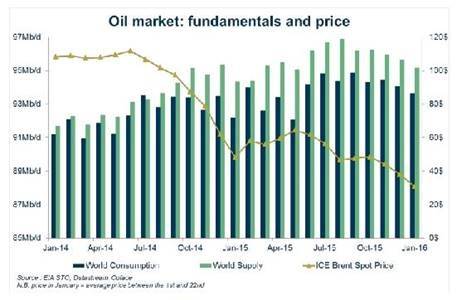

On the demand side, the slowdown of the Chinese economy (the world’s second largest oil consumer) and the tepid economic recovery in Europe are all weighing on demand. With 2015 marked by a slight increase of global oil consumption to 93.8 million barrels per day (Mb/d), global demand 2016 is forecasted to reach 95.2 Mb/d according to the EIA (Energy Information Administration). In particular, OECD demand should remain stable.

On the supply side, oil supply reached 95.7 Mb/d in 2015. This should decrease slightly to 95.2Mb/d in January 2016 and is likely to reach 95.9 Mb/d over the year. OPEC crude oil output, which represents 40% of the oil supply, crept up to 38.6 Mb/d at the end of 2015 with record rates from Iraq. Iraq exports were high after exports from the south rose to their highest and should reach 4.4Mb/d in January. Saudi Arabia also boosted its production (+0.3 Mb/d in 2015) to defend its share of the global oil market.

In 2016, OPEC crude oil production is expected to surge by 0.9 Mb/d, with the return of Iran production after the suspension of the sanctions on January 16, 2016. Conversely, US shale production is already falling and this should continue. The drop in the oil price has weakened US shale producers (the US rotary rig counts decreased by 63% between January and December 2015), limiting their margins.

U.S. crude oil production averaged 9.4 Mb/d in 2015 and is forecasted to average 8.7 Mb/d in 2016 according to EIA estimates. US production will drive the decline in non-OPEC production by 0.6 Mb/d in 2016, which would be the first US decline since 2008. However, Russian oil output should persist at record highs, underscoring the country's resilience to lower oil prices and sanctions.

The high level of inventories also explains the oversupply (commercial stocks are equivalent to roughly 66 days of consumption), increasing by 1.9 Mb/d in 2015.

Tensions between Iran and Saudi Arabia had no significant effect on oil price. This can be explained by the size of the oversupply, which makes the market less responsive to a threat of oil production cutbacks.

A strong rebound in the oil price is not expected in the short term. According to the current oil forward curve (which represents the expected future path of spot price), oil price should increase gradually to reach only $45 by the end of 2018.

Risks

Some risks can affect the trajectory of oil price. Several shocks may hit the market and cause a change in price level. The entry of Iran in the market and the speed of the recovery of its oil export will affect the outlook for the supply. As Iraq, some countries call for an urgent OPEC meeting to reduce production quotas and a cut could change the story.

Beyond the worsening of the trade balance, most of oil producers rely on oil export to finance their state budget. Except some developed oil producer as Norway, oil producer states play an important part in the economic activity throughout public expenses. With oil revenues falling, the ability of maintaining public expenses and promoting economic activity is jeopardised.

However, oil producers are not all in the same boat. Saudi Arabia seems to have less to loose and is showing resilience to the fall of oil price: firstly the country has one of the smallest extraction and production cost among the oil producers, and secondly it has the biggest reserve fund (more than $500 billion).

Russia and Iran remains deeply impacted by sanctions and cannot reduce their oil production. The most vulnerable countries as Algeria and Venezuela suffer the most from the drop of prices with a high extraction cost and important financial needs. For them, long term low prices could lead to an economic crisis.