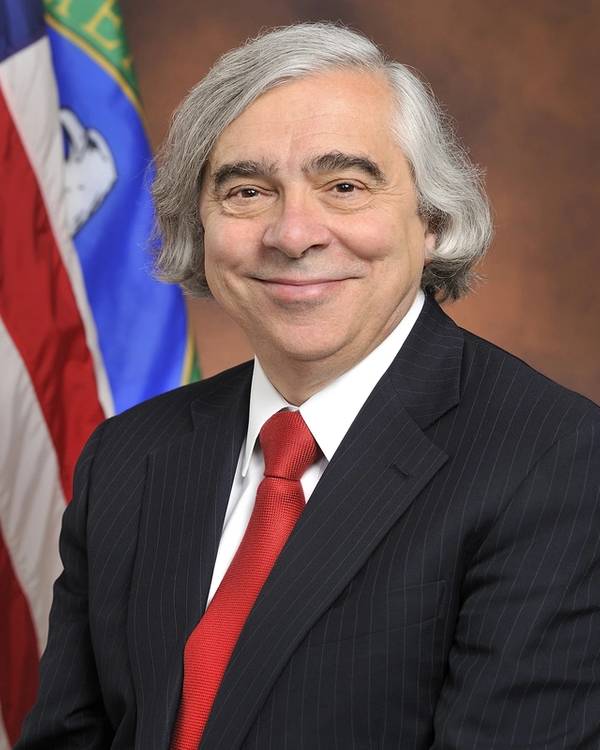

The maritime industry was front and center yesterday in Washington, D.C., as “getting more oil on the water” was touted as one piece of the puzzle in ensuring future U.S. energy security, said U.S. Secretary of Energy Ernest Moniz. Sec. Moniz spoke yesterday at the U.S. Energy Information Administration (EIA) 2015 EIA Energy Conference at the Renaissance Downtown Hotel in Washington, DC. Building U.S. energy security via a strategic evaluation of the U.S. Strategic Petroleum Reserve (SPR) was central to his comments, noting that the size, shape, release triggers and distribution channels of the SPR oil are under review.

The SPR is the largest stockpile of government-owned emergency crude oil in the world with a capacity of 727 million barrels, established in the aftermath of the 1973-74 oil embargo. Potential disruptions to U.S. energy flow range from political disruptions to natural disaster. Regardless of cause, Sec. Moniz said that the world is a much different place from the time of its creation more than 40 years ago, and natural disaster disruptions as recent as Hurricane Sandy – where crude oil was plentiful but delivering needed gas and diesel finished products to consumers was a problem – highlight the need for a thorough evaluation.

Changing Energy Dynamics

In addition to unanticipated disruption, Sec. Moniz said that the role of the U.S. a major energy producer has stretched an already tight transportation infrastructure.

“Many pipelines were built and flows reversed to accommodate increases in domestic oil production,” said Sec. Moniz. “Without railroad and inland waterways, we would have been unable to rapidly take advantage of the dramatic growth of oil and gas production.”

The growth in energy flow, as well as the growth in transport of product and supply to new energy fields across the country, has strained a “relatively fixed transportation infrastructures, rail, barge, locks on inland waterways, port facilities,” said Sec. Moniz. “These infrastructures are shared by energy and many other commodities. The impacts of this congestion have ranged from higher shipping prices, to reliability as key commodities such as oil, coal ethanol and agriculture product compete for transportation services. Assessing the operational health and value of these shared infrastructures is key to advancing a more fulsome energy security.”

While changes to the system may be readily identifiable, funding improvements is another matter. Regarding SPR, Sec. Moniz estimated $1.5 to $2 billion is needed for fundamental SPR distribution upgrades, funds needed at a time when it can’t get the money from Congress to conduct deferred maintenance.

With necessity the mother of invention, Sec. Moniz suggests it is time to think outside the box regarding funding. “It may be that we can create a net increase in value by converting a small portion of our current crude oil inventory into needed investments in modernizing the SPR infrastructure.”

The Quadrennial Energy Review (QER) releases in April 2015 includes recommendations focused on innovative funding mechanisms for these infrastructures, an assessment of energy impacts and needs of shared infra, and funding for port connectors to highways, waterways and rail that are being stressed by new energy supplies.

“These shared infrastructure improvements would enhance energy security by improving energy availability, making it easier, more economical and more robust to move energy commodities and material around the U.S.,” said Sec. Moniz.