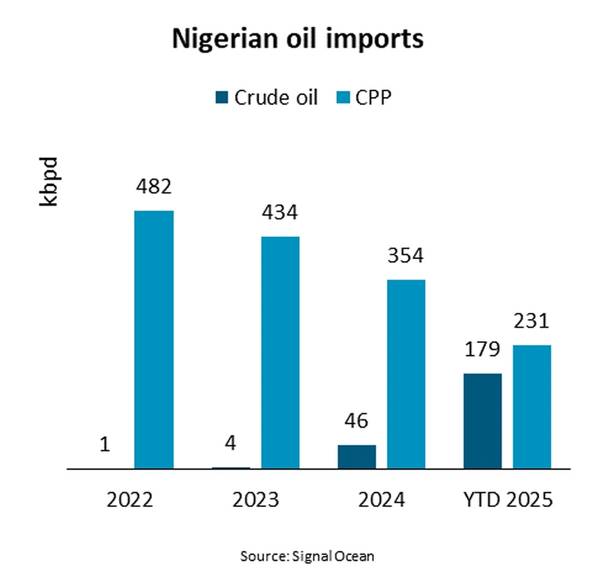

“During the first seven months of 2025, Nigeria’s seaborne imports of clean petroleum products (CPP) declined by 39% compared to the same period in 2024, reaching 230 thousand barrels per day (kbpd). The decrease follows a 19% reduction during 2024,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.

The reduction in imports is due to the start of operations at the 650 kbpd capacity Dangote refinery early last year. By June 2025, the refinery’s output had reached 550 kbpd, as reported by company officials.

“Imports from Northern Europe have reduced the most. In 2022-2023, prior to the opening of the Dangote facility, Nigeria imported an average of 271 kbpd per year of CPP from North Europe, representing 60% of Nigeria’s total seaborne CPP imports. In 2025, imports have dropped to 48 kbpd and only 21% of total imports,” says Rasmussen

These developments highlight how the Dangote refinery has been effective in creating a domestic supply of CPP, reducing the country’s dependence on imports. Despite this progress, supply chain disruptions have prevented the refinery from relying exclusively on Nigerian crude oil, necessitating the use of imported crude.

Consequently, Nigeria's crude oil imports have risen markedly, growing from negligible volumes in 2022-2023 to 179 kbpd year-to-date and reaching 434 kbpd in July 2025. Approximately two-thirds of year-to-date imports originated in the United States.

Data provider Kpler observed that, in July, the refinery’s US crude oil imports surpassed its use of domestic crude oil for the first time. Reports suggest that US crude offers advantages such as improved supply security, higher yields and often more competitive pricing compared to Nigerian crude.

As a result, Nigeria’s crude oil exports have remained stable in 2025, despite the increasing CPP production at the Dangote refinery.

“According to Dangote officials, the refinery expects to transition entirely to locally sourced crude before the end of the year. Additionally, anticipated improvements in processing efficiency will increase the facility’s capacity to 700 kbpd by the end of 2025. That could end the volume of crude oil that has supported Suezmaxes and VLCCs and further decrease CPP imports transported by Handysize and MR product tankers,” says Rasmussen.