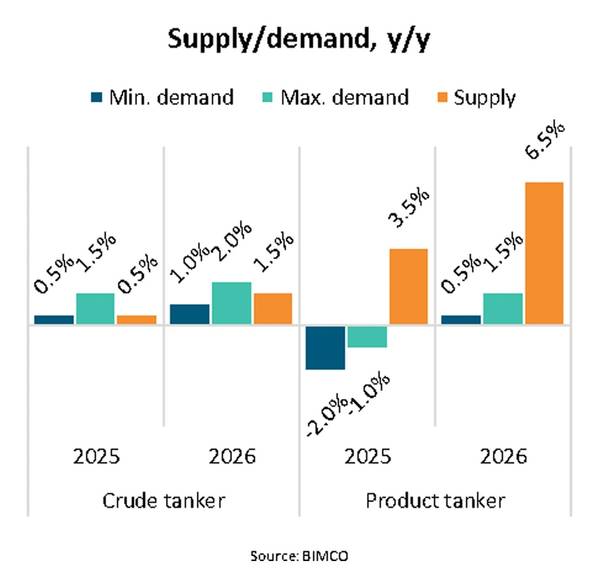

“We forecast a balanced development in the crude tanker market in 2025 and 2026 while we expect the product tanker market to remain weaker than in 2024. The product tanker suffers under the weight of increasing supply growth and weaker demand growth due to shorter sailing distances,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.

Due to OPEC+’s recent decision to reverse oil production cuts, the International Energy Agency (IEA) has increased its crude oil supply forecast significantly. According to IEA’s forecast, oil demand and refinery throughput can, however, not keep pace the expansion in supply.

“As a result of increased OPEC+ production, the IEA expects an oil surplus averaging 2.3 mbpd during the second half of 2025 and 3.0 mbpd during 2026 while peaking at 4.1 mbpd in the first quarter of 2026,” says Rasmussen.

The U.S. Energy Information Administration (EIA) forecast that the oil surplus could drive the price of Brent down to an average of USD 63/barrel during the second half of 2025 and USD 51/barrel during 2026.

The lower oil prices could help underpin demand but also encourage increased stock building resulting in increased demand for tankers.

However, extra product tanker demand may be limited as refinery throughput is mostly expected to grow in countries that are currently net importers of refined products.

Instead, we have lowered our demand forecast for product tankers compared to our previous report. Average sailing distances have shortened, partly due to an increase in the number of ships that sail via the Suez Canal instead of via Cape of Good Hope.

When ships can return fully to normal Red Sea and Suez Canal routings remains uncertain, and no further shift in routings has been included in our forecast.

If successful, the current attempt to negotiate peace between Russia and Ukraine could lead to a normalisation of trade with Russia. Like a return to normal Suez Canal routings, sailing distances could shorten and demand growth recede as trading patterns could begin to transition back towards the pre-war trade mix.

“During the first half of 2025 both crude and product tanker year-on-year demand growth as well as rates and prices development has been negative. We predict that demand will begin to improve during the second half of the year, but that product tanker rates and prices could still fall behind 2024 levels due to high supply growth,” says Rasmussen.