Saudi Arabia's crude oil shipments to its biggest customer, China, are expected to drop to their lowest level in more than a year in April, trade sources said on Thursday, partly due to maintenance programmes at Chinese refineries owned by Sinopec.The OPEC producer allocated 34 million barrels of Saudi oil in April to its Chinese customers, down from 41 million barrels in the previous month, Reuters data showed…

“We forecast a balanced development in the crude tanker market in 2025 and 2026 while we expect the product tanker market to remain weaker than in 2024. The product tanker suffers under the weight of increasing supply growth and weaker demand growth due to shorter sailing distances…

Political winds blowing a raft of new tariffs and incoming supply uptick suggests a volatile 2025 Bearish sentiment crept into the car carrier market in June after the European Union (EU) announced increased import tariffs for Chinese-made electric vehicles (EVs) up to as much as 45…

In its Q3 Dry Bulk report, Maritime Strategies International (MSI) estimates dry bulk newbuilding orders in the first eight months of the year above 25m dwt, with the potential for further upside on the back of late-reported deals. Despite a slight August lull…

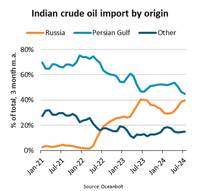

“During the past three months, India has relied on Russia for 40% of its seaborne crude oil import. Year-to-date, volumes have reached an average of 1.6 million barrels per day (mbpd), an increase of 1000% compared to 2021, before Russia invaded Ukraine…

The specialized deepwater oil & gas and floating offshore wind segments will share many of the same stakeholders and supply chains, competing for increasingly scarce resources.To receive a full version of Inteletus analysis, click hereThe established…

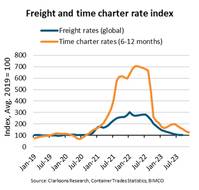

'So far this year, container volumes have fallen nearly 2% year-on-year while average freight rates have declined, reaching 2019 levels in September. Since then, they have continued to fall. However, the cost to charter a ship remains 25% higher than in 2019…

As geopolitical upheaval continues, Peter Sand, Chief Analyst, Xeneta, explores how global trade patterns have (and will) evolve.Geopolitical unrest could have dramatic and long-term impacts on global trade patterns for all goods and commodities…

While drama in the container shipping sector has calmed a bit, container carriers still wrestle with unexpected drops in demand. Peter Sand, Xeneta, discusses vessel capacity moves and their likely impact on rates, as well as the first containership…

It’s been another bumper month for long-term contracted ocean freight rates, as the cost of securing container shipments climbed by 10.1% in June. Following on the heels of a record 30.1% hike in May, this now means rates stand 169.8% higher than this time last year…

According to the latest crowd-sourced data from Xeneta, long-term rates for reefer containers on the key US West Coast to Far East route soared almost 60% in April.In its report Xeneta notes a surge in rates of around $2000 per 40-ft. unit after the latest 12-month contracts came to a close…

Despite months of softening on the backhaul North Europe to Far East trade, with rates on the spot market closing in on $1,000 per FEU for normal-dry containers, spot rates for reefer containers on this trade have been stable since early 2021…

Spot market earnings for VLCCs will average $2,500/day in 2022 on a non-eco, no scrubber basis (US $11,000/day for ECO-designs, without scrubbers), while the peak year for VLCC spot market earnings have been pushed out to 2025, amid substantial supply-side support…

The Signal Group offers an exhaustive overview of the trends in the dry bulk and tanker markets that both defined 2021, and offer a glimpse as to what might be in store for 2022 and beyond. The report is excerpted in short below; to see the full report CLICK HERE…

Chinese iron ore futures fell below a key 1,000 yuan per tonne level on Thursday, falling more than 5% to their lowest in more than two months as domestic consumption remains sluggish on steel production controls.The most active iron ore futures on the Dalian Commodity Exchange…