It has been another challenging week in the sub-continent markets, with a resurgent India and a Bangladeshi market that is still reeling from some of the recent falls in local steel, which have seen nearly $50/LDT knocked off the prices this week alone, according to GMS.

India has managed to regain over half of the falls seen over the previous few weeks, but the market overall does remain extremely volatile.

Commodity prices and volatile currencies show few signs of cooling off any time soon, as the Russian invasion of Ukraine enters its second month and thus far shows no signs of abating. The Covid situation in China too may be a growing cause for concern as various cities (including the economic hub of Shanghai) enter a fresh series of lockdowns, while the rest of the world is just starting to open again.

While mills in Bangladesh had recently stopped buying steel at these higher overall levels approaching $700/LDT, they have however, slowly started to acquire small portions of inventory just to stay open and this will surely lead to greater confidence in purchasing larger amounts in due course, in iorder to bring Chattogram prices back up again. Finally, the Turkish market sails through an uneventful week, with no changes or fresh arrivals reported.

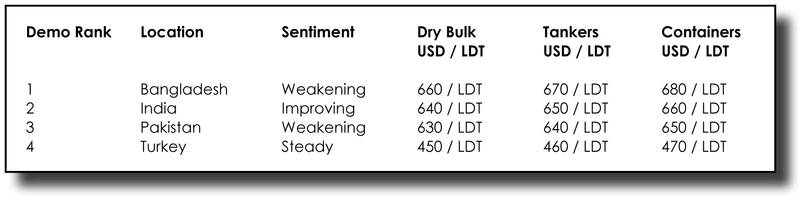

For week 12 of 2022, GMS demo rankings / pricing for the week are as below.