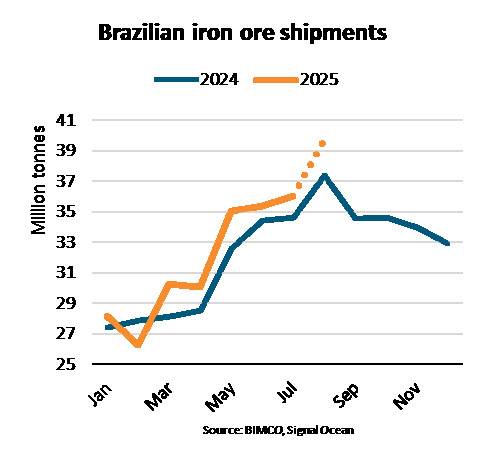

Between January and August 2025, Brazilian iron ore shipments are expected to rise 4% y/y, supported by stronger mining activity. Shipments to China have increased despite weaker demand, replacing shipments from Australia, Peru and India, says Filipe Gouveia, Shipping Analysis Manager at BIMCO.

Brazil is the world’s second-largest exporter of iron ore, accounting for 23% of global shipments, while Australia leads with 54% of cargoes. Out of global shipments, 73% are destined for China while an additional 11% go to other East Asian countries. Notably, 89% of global shipments are transported via the capesize segment, including VLOCs, but this figure is as high as 97% for Brazilian cargoes.

“The increase in iron ore shipments out of Brazil has positively impacted tonne mile demand, especially for the capesize segment. Brazilian cargoes sail on average nearly three times the distances of Australian cargoes and nearly twice the global average distance, keeping ships at sea for longer. This contributed to an estimated 1% y/y increase in global tonne mile demand for iron ore between January and August 2025, despite a 1% drop in cargo volume,” says Gouveia.

So far this year, losses in cargo volume have been primarily from Australian, Peruvian and Indian cargoes. Australia experienced disruptions in mining amid severe weather between January and May, while Peru experienced port handling disruptions in May and June. Indian shipments significantly weakened due to price competition and stronger domestic demand. Unlike other exports, Indian cargoes are primarily transported by the supramax segment.

On the importer side, Chinese iron ore demand has dropped due to a 3% y/y decrease in steel production between January and July. While an 11% y/y increase in steel exports has kept production from dropping further, it has been insufficient to compensate for weak domestic demand. The property sector crisis remains, and construction activity keeps declining since there are still 408 million square metres of excess real estate inventory. Manufacturing and infrastructure have fared better, but the official manufacturing PMI has been below 50 for the past four months. In Japan and Korea, steel production has also declined.

“Looking ahead, Chinese steel demand is expected to keep falling, according to the OECD, and economic activity in China is expected to slow. However, positive developments may still emerge for iron ore shipments, mitigating these losses. The start of operations in the Simandou mine in Guinea is expected to boost global supply and lengthen average sailing distances from November 2025. This may pressure iron ore prices and encourage China to increase imports over domestically mined ore,” says Gouveia.