Houston, Texas-based PortVision, a leading provider of business intelligence solutions for the maritime industry, shares its projections for the top vessel-tracking trends that it believes will have the greatest impact on the maritime industry during 2014. They identify the following trends to watch:

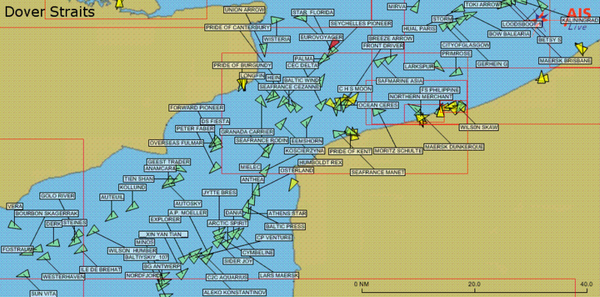

Trend #1: Improving real-time visibility and decision-making. Advances in AIS-based vessel-tracking tools and technology that move the industry beyond simple points on a map to on-demand and immediately actionable business insights and intelligence.

Trend #2: Improving marine terminal efficiencies. AIS-based terminal management software it helping to optimize marine operations in the petrochemical supply chain by providing continuous visibility to all dock and vessel activities, enabling senior management to cut costs and labor requirements, optimize the supply chain, and drive better business decisions.

Trend #3: Handling the flood of waterway traffic hitting the U.S. Gulf Coast. AIS-based enterprise software tools with dock and jetty scheduling and optimization capabilities are enabling the marine transportation infrastructure to meet an unprecedented increase in volume demands.

Trend #4: Controlling demurrage costs through AIS-based vessel-tracking tools. This is becoming increasingly important as tanker rates soar because of the scarcity of Jones Act vessels available to ship oil and refined products between U.S. ports.

Trend #5: Collaborating to improve data accuracy and decision-making. This includes sharing actual AIS- based transportation cost information so that, for instance, traders can make significantly better decisions than if they were to rely on often-imprecise anecdotal and per-barrel costs, alone.

Trend #6: Simplifying vessel fit management. AIS-based enterprise terminal management tools are enabling terminals to streamline all key processes associated with dock fit, dock scheduling, and dock activity logging.

Trend #7: Strengthening the industrys focus on safety. AIS-based terminal enterprise software suites make it easier to support industry initiatives such as the Oil Companies International Marine Forum (OCIMF) Marine Terminal Management and Self Assessment (MTMSA) guide, which major oil companies increasingly use to evaluate terminals.

Trend #8: Supporting sustainability initiatives. AIS data is being used for applications ranging from monitoring participation in voluntary vessel speed reduction (VSR) programs, to virtual tendering, in which AIS-based tools enable accurate arrival predictions and flexible scheduling for berthing upon arrival.

Trend #9: Moving AIS into new marine transportation applications. This includes potential examples such as virtual aids to navigation (ATON), in which authorities can use AIS to transmit navigation information where no physical ATON such as a lighthouse, buoy or beacon exists.

Trend #10: Averting disaster. The industry is moving to a proactive, rather than reactive, approach to incident management by taking advantage of AIS data.

Detailed descriptions of PortVisions' top ten anticipated maritime vessel-tracking trends for 2014 can be found here: http://www.portvision.com/news---events/press-releases---news/bid/370715/Top-Vessel-Tracking-Trends- For-2014