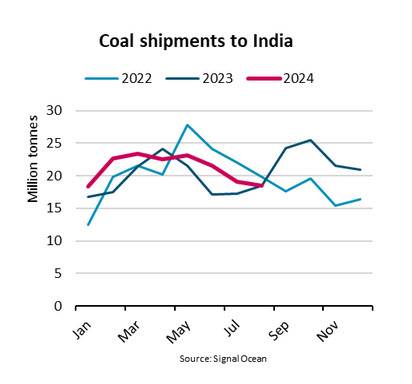

Between January and August 2024, coal shipments to India rose 10% y/y, outpacing an 8% y/y increase in domestic coal mining. Thermal coal shipments were a key driver, supported by strong electricity demand and coal import mandates.

However, during the rest of 2024, growth may slow as demand cools, says Filipe Gouveia, Shipping Analyst at BIMCO.

India, the world’s second largest coal importer, saw its electricity generation rise 9% y/y between January and July 2024. Power generation from coal rose 13% y/y, compensating a 6% y/y decrease in hydro power generation due to low water levels.

Since 2022, all power plants in India have been under a mandate to blend a minimum ratio of imported coal in their electricity generation to ensure supplies and avoid blackouts. This ratio was set at 4% for the period between June 27 and October 15, 2024, down from 6% previously.

“Dry bulk carriers in the capesize and panamax segments benefited the most from an increase in coal cargoes, as we saw a shift towards larger ships transporting coal to India. So far in 2024, cargoes aboard supramax ships stagnated and their cargo share of coal shipments to India fell to 21% from 23% in 2023,” says Gouveia.

Indonesia is the origin of 45% of India’s seaborne coal imports, nearly all of which is thermal coal. Supramax ships are sometimes preferred for these routes due to limited crane availability or draft restrictions in smaller ports.

Although shipments have surged so far in 2024, they may grow at a slower rate over the rest of the year. The monsoon rains in India ramped up in August after a slow start, leading to 26% y/y increase in water levels in reservoirs. This should allow hydro power generation to recover, reducing coal demand.

Coal inventories in power plants are also at healthy levels, with only 22 power plants at critical levels. It is still unknown whether the government will ease or eliminate coal import mandates in October, but should they do so, imports could grow at a slower rate.

“Unlike in advanced economies where demand has peaked, or in China where a large investment in renewables is reducing demand, India’s coal demand is still expected to rise in the medium term. However, import demand growth will be limited by the country’s ambitious targets to increase domestic mining by an average of 7% per year until the end of the decade. Should India reach its target, cargo growth would slow although a reduction in volumes from current levels is unlikely,” says Gouveia.