Weekly Freightos Baltic Index Update

Posted by Michelle Howard

January 22, 2019

Graphic: Freightos

Highlights of the Freightos Weekly Baltic Index Report ...

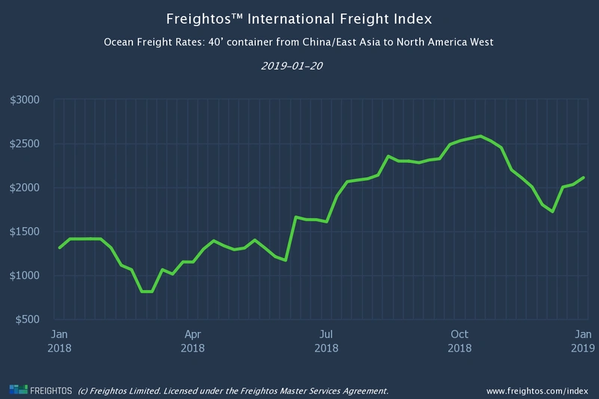

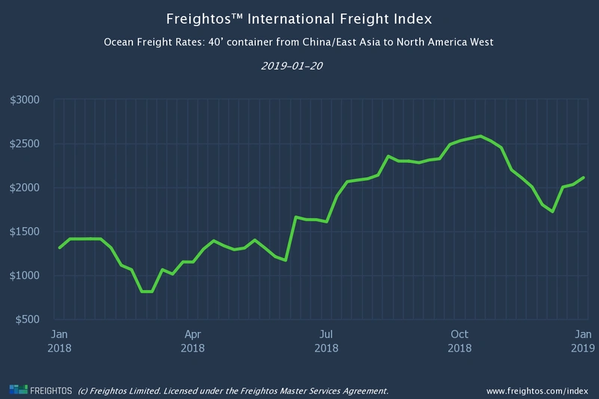

- Just as the January 1 GRIs were losing traction, the mid-month round lifted transpacific prices back up again. The net impact was a 4% week on week rise for both lanes. China-West Coast went up from $2,031 to $2,110, and China-East Cost went up from $3,171 to $3,292.

- Having lost ground following January 1’s GRIs, the mid-month GRI picked up transpacific prices again. The net effect of dipping, then rising prices last week was a 4% week on week rise for both lanes.

- GRIs are sticking currently because space is tight on sailings – post-Christmas replenishment is in full swing coupled with the CNY bottleneck fast approaching.

- China-North Europe prices continue to rise, good news for carriers looking for high prices during that lane’s contract negotiation season. Several carriers have implemented mid-month FAK increases or fuel-related surcharges (including Hapag-Lloyd’s peak season surcharge).

- Once China returns to normal after the CNY shutdown, transpacific freight prices usually drop dramatically. Last year, between 25 February and 29 April, West Coast prices fell by 19%, East Coast by 21%. In 2015, between 26 February and 30 April, the corresponding drops were 23% and 26%. Continuing uncertainty over China trade tariffs this year, however, may lift demand and lessen the extent of the seasonal price falls.