Potential USTR port fees of c.$1 mil per voyage for non-US built car carriers entering the US targeting c.95% of the global fleet from mid-October, combined with this week’s signals from Washington suggesting a sooner-than-expected reopening of the Red Sea, would deal a heavy blow to car carrier demand. Together, these factors comfortably support a scenario of negative car-mile growth through 2026 and 2027.

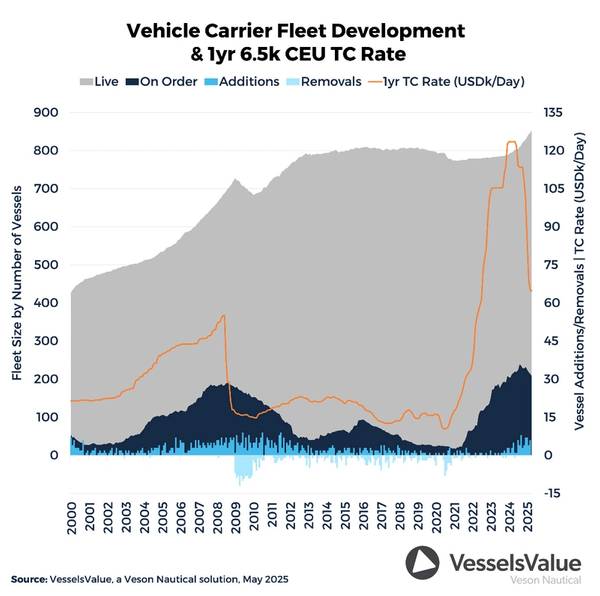

By contrast, supply growth is expected to be in positive double-digit territory over the same period, suggesting an accelerated correction in both time charter rates and asset values, with levels likely reverting towards long-term historical averages. A major scrapping phase—reminiscent of 2009—is likely to follow, as history often rhymes. Red lights have started flashing in this sector, but for now, the global economy remains at amber.