New analysis by Maritime Strategies International cites emerging evidence that the demand side of the industry will prove better-insulated from tariffs than was expected earlier in the year, while a dynamic where Chinese exporters continue to export their manufactured goods surplus - above all to emerging economies - has significantly buoyed trade so far this year.

In its Q3 market report Faltering Freight, MSI, notes that global container trade trends started 2025 on a strong footing and following an estimated 4.9% year-on-year expansion in the first quarter, world container trade is estimated to have grown by 4.4% yoy in Q2. Further ahead, MSI believes there will be a degree of industrial sector retrenchment in China in the next several years, but for now this dynamic remains supportive of global container trade.

Q2 25 was another strong quarter for mainlane container trade volumes and was followed by healthy data in July for the Asia-Europe and Transatlantic trades. At the same time, it has been a volatile period on the Transpacific trade, although even here volumes sat nearly 6% higher on a ytd basis through August.

Overall mainlane headhaul volumes logged a 4.9% yoy expansion in Q2, following a 9.5% yoy expansion in Q1. This is very likely to be the strongest pace of expansion this group of trades will record for some time.

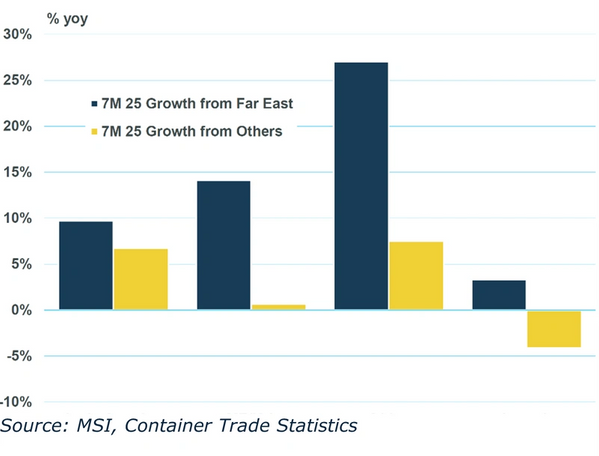

Long-distance non-mainlane trades have been a key motor of overall containerised trade growth in recent years, and that continued over the first half of 2025. The Transpacific is the main driver of MSI’s forecast that mainlane headhaul trade will contract in 2026, but slower Asia-Europe growth also contributes.

MSI has actually revised up its projections for next year on the basis of greater assumed resilience to tariffs, but our forecasts for next year come with notable downside risks. As with the mainlane trades, MSI places fairly heavy emphasis on the competitiveness of Chinese exports here as a key driver.

“While exports from South-East Asia, as opposed to China, could account for a growing share of this surge in Far East exports, wider evidence from Chinese customs data does suggest that it is China’s export powerhouse that is having an outsized impact,” explains MSI Director Daniel Richards. “Overall, MSI has made upward revisions to our forecast for key non-mainlane trades in 2025, but otherwise our forecasts are stable and we expect a more muted pace of expansion in 2026.”