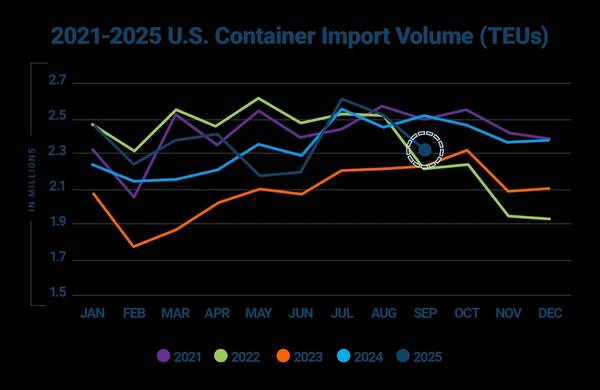

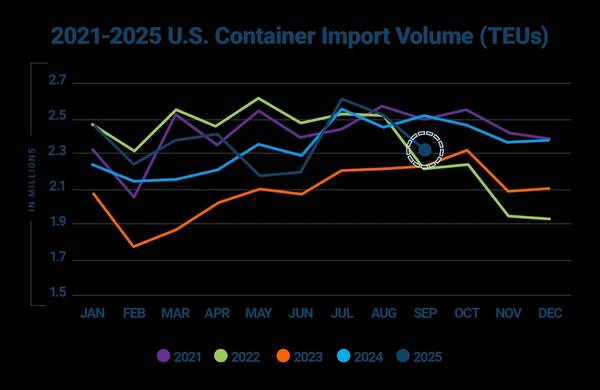

September U.S. Container Imports Contract Amid Tariff Uncertainty

October 20, 2025

© Descartes Systems Group

Descartes has released its September Global Shipping Report, which analyzes the latest economic and logistics trends shaping U.S. imports and global trade.

According to data from Descartes’ global trade intelligence platform, Descartes Datamyne:

- U.S. container imports declined 8.4% from August, reaching over 2.3M TEUs in September – representing the third-highest September on record. Its volumes are 1.9% ahead of the same period in 2024, demonstrating resilience in demand despite trade uncertainty.

- Imports from China fell 12.3% month-over-month and 22.9% year-over-year. Major categories posted steep declines, including aluminum (-43.8%), footwear (-33.9%), and electric machinery (-31.5%). Plastics were comparatively resilient, slipping only 1.5% while growing their share of total Chinese exports to 13.5%.

- Imports from China face mounting pressure amid new section 301 vessel fees taking effect on 10/14 and the looming 11/10 expiration of the U.S.–China tariff truce

- Imports from the top 10 CoO fell 9.4% month-over-month – a combined decline of 169,126 TEUs led by China which dropped 106,751 TEUs. Significant declines were also recorded from Italy (-15.1%), South Korea (-14.1%), Germany (-11.6%), Hong Kong (-11.2%), and Taiwan (-10.2%).

- Volumes at top 10 U.S. ports declined by 7.9% month-over-month, with a combined loss of 169,455 TEUs. Significant drops include Long Beach (-11.4%), Baltimore (-12.6%), and Savannah -(9.1%), while Tacoma was the only port to record growth at 4.7% month-over-month.

Major carriers continue to bypass the Red Sea and reroute around the Cape of Good Hope, extending Suez-linked schedules by one to two weeks.

The Liberation Day tariffs remain active but under legal pressure, with an appeals court ruling now under review by the U.S. Supreme Court. At the same time, the U.S. government shutdown has delayed key economic data releases and slowed regulatory processes tied to trade compliance, adding another layer of uncertainty.

New Section 301 vessel fees, which took effect October 14, may also raise shipping costs for Chinese-built or Chinese-operated vessels, further complicating import planning. Combined with the November 10 expiration of the U.S.–China tariff truce, these factors keep trade policy risk elevated and planning complex, even as U.S. ports continue to demonstrate resilience under sustained volumes.