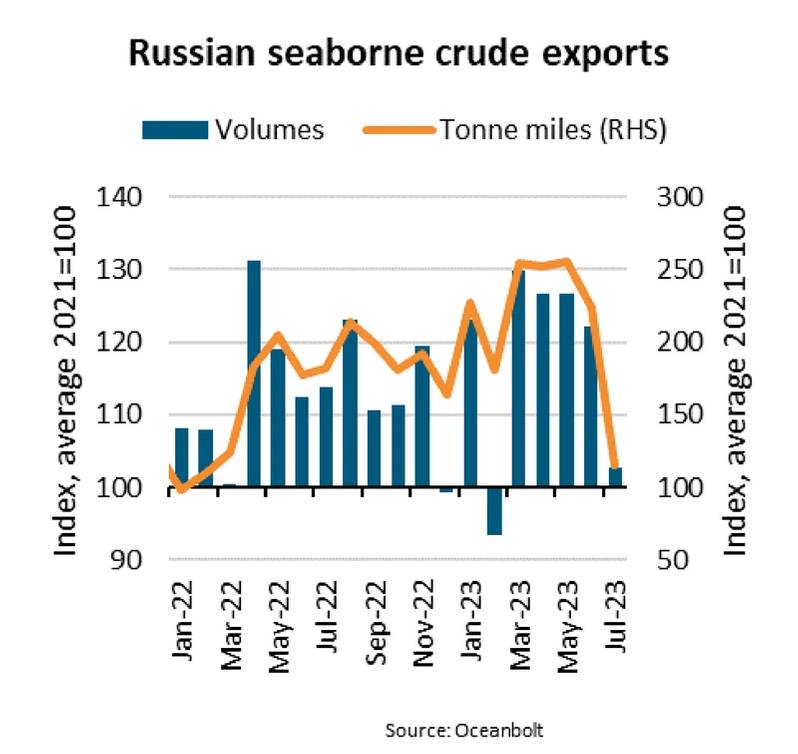

Russian seaborne crude oil export volumes have remained strong and grew 13% y/y in 2022 despite the invasion of Ukraine. However, after a 4% m/m fall in June, volumes fell another 16% m/m in July, and the Russian administration has announced export cuts for August, says Niels Rasmussen, Chief Shipping Analyst at BIMCO.

An even more important factor for the crude tanker market is how EU regulations have reshaped crude trades. China, India, and Türkiye have replaced EU countries as the main buyers of Russian crude oil, resulting in average sailing distances increasing 80-90% and significantly increasing tonne miles and demand for crude tankers.

The declining volumes in July again brought new changes to the destination split. India has recently taken 32-38% of the Russian export volumes but in July took only 12.5%. Instead, especially Türkiye and Egypt have increased their share.

“The changed destination split means that the average sailing distance for Russian export volumes fell 38% m/m in July and ended 30% lower than July last year. Therefore, tonne miles of the Russian July exports fell 48% m/m and 30% y/y,” says Rasmussen.

The Russian administration has announced that exports in August will be reduced by 500,000 barrels per day to support oil prices (approximately 2.1 million tonnes). Seaborne export volumes fell 3.3 million tonnes in July, and it remains to be seen whether the announced reductions will be in addition to the July reduction. If exports fall further, August volumes would end near 15 million tonnes, a level last seen in September 2021.

Despite the decrease in Russian export volumes, an increase in particularly Iraqi and Brazilian exports meant that global crude oil export volumes overall increased 3% m/m in July. However, the changes in origin and destination patterns had a significant effect on average sailing distances, and we estimate that tonne miles fell 15% m/m.

“It appears that the reduction in Russian crude oil export volumes will last for a while, and it may also take a while before average sailing distances recover. Indian refineries are undergoing maintenance and the monsoon has brought lower demand. Considering the lower demand, and that the price for Urals crude has recently breached the G7 price cap, some owners may therefore exit the Russian business despite the premium freight rates available,” says Rasmussen.