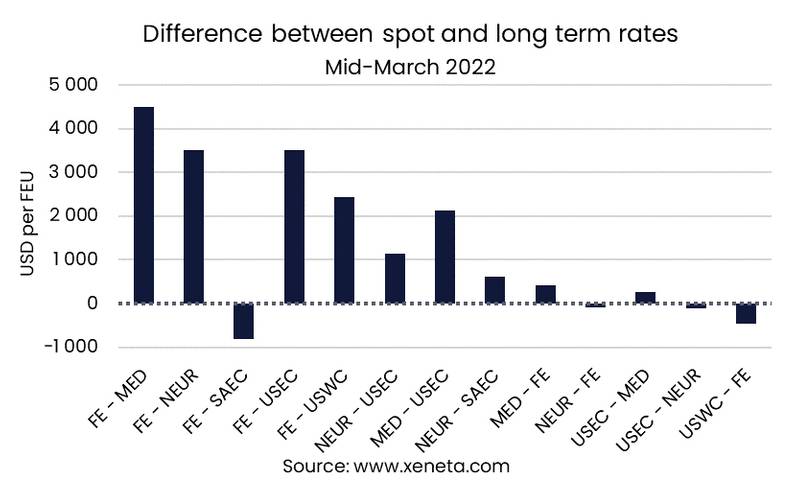

The Far East to South American East Coast trade is the only front haul trade where the long term is lower than the average spot rate among Xeneta's top 13 trades.

Long-term rates on this trade are still below their October highs, but they have been steadily rising since 2022. As of 15 March, long term contracts from the past three months were $800 per FEU above the spot market, at $10,400. In comparison, spot market rates have declined since November 2021, falling from $13,000 to $9,150 in mid-March 2022.

On all the other major trades out of the Far East, long-term rates in mid-March are between $2,400 and $4,500 lower than the spot market, with the highest difference between the short- and long-term market to be found on the Far East to Mediterranean trade.

Despite recent spot market softening, long term rates on fronthaul trades have not shown the same weakness and are projected to continue at or near current levels for the remainder of the tender season.

The difference between short and long term rates is much smaller on the major backhaul trades, with the biggest difference coming on the US West Coast to Far East trade, where long term rates in mid-March were 40% higher than the spot market. In fact, long term rates here have been higher than spot rates since October 2021.

As there aren’t the same capacity constraints on the backhaul trades compared to the fronthaul, fundamental market dynamics have not been overshadowed by congestion and other disruptions as on the spot market.