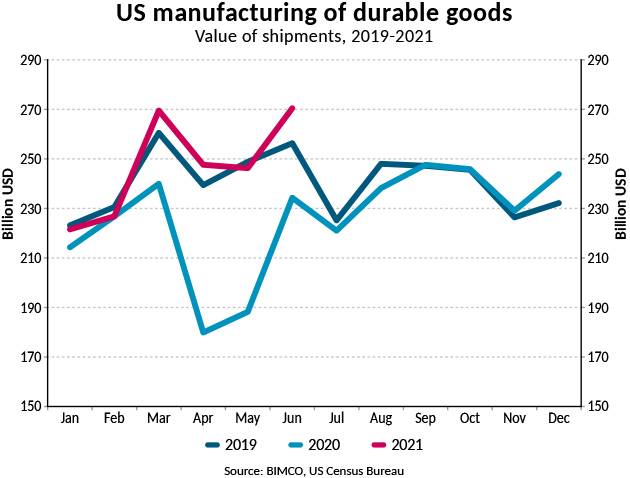

U.S. manufacturing of durable goods, which has been lagging the wider recovery of the U.S. economy, hit an all-time high in June when $270.5B worth of goods was produced. This brings total manufacturing of durable goods so far this year to $1,482 billion, a 15.5% increase compared with the first half of 2020.

Since the production of durable goods in the first half of 2021 is up 1.6% from the first half of 2019, this section of the industry has now officially returned to its pre-pandemic levels.

Manufacturing activity is expected to have continued its growth in July, partly as the Purchasing Managers’ Index (PMI) reached its highest level on record at 63.4 during that month. Like the increase in production and sales in the manufacturing sector, the strong PMI also reflects delays in supplies and higher prices for inputs which somewhat counter-intuitively lead to a higher PMI. These issues are felt world-wide and are threatening to upset the global recovery in manufacturing and add to inflation of consumer prices.

Despite recovery, manufacturing falls way short of retail sale records

Although manufacturing of durable goods has now recovered to pre-pandemic levels, the 1.6% growth recorded in the first half of 2021 is dwarfed by the 20.8% retail sales growth seen in the same period, also compared to 2019. The strong growth has fueled a US import surge and caused congestion around US ports. The congestion is now felt in container shipping world-wide, stretching hinterland connectivity.

“One of the biggest winners of the US stimulus packages has been the retailers, as consumer income, and thereby spending, has been highly protected. Manufacturing on the other hand has been on a much longer road to pre-pandemic recovery and has not benefitted from the stimulus to the same extend as retail,” says Peter Sand, BIMCO’s Chief Shipping Analyst.

“Despite the recovery, supply chain disruptions could cap the strong growth in US manufacturing, an issue that can neither be ignored nor resolved in the short term,” says Sand, adding:

“Around half of US manufacturing consists of durable goods., They compete with billions of dollars’ worth of imported durable goods every year. The recovery in US manufacturing will not put an end to the high demand for US imports, especially as the inventory to sales ratio remains low compared with recent years. This should leave plenty of space for inventories to be re-stocked, especially as retailers turn their attention to the upcoming holiday seasons.”