2023 was another challenging year for Port of Antwerp-Bruges. Geopolitical tensions and slowing global economic growth are driving down industrial production and trade flows, says the port.

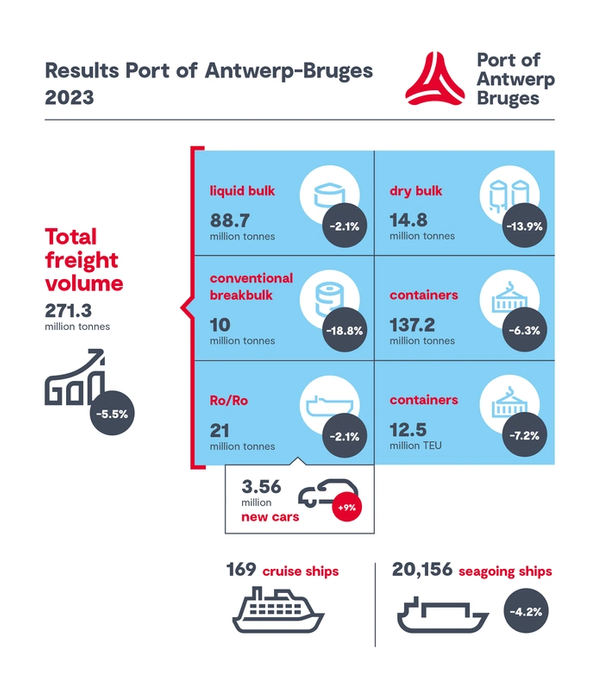

Total throughput, 271 million tonnes of cargo, was down 5.5% from the previous year.

Weak global economic growth and lower demand for commodities led to a decrease in container throughput of 6.3% in tonnes and 7.2% in TEUs, compared to 2022. In contrast, Port of Antwerp-Bruges' market share in the Hamburg - Le Havre range rose 0.6% points to 30.2% in 2023.

Liquid bulk throughput was down 2.1% during 2023. Fuel throughput was up thanks to strong growth in diesel and paraffin while petrol and fuel oil are down. Naphtha throughput was down due to lower industry demand, while LPG throughput was static.

The chemical sector is under pressure across Europe due to high energy, raw material and labour costs and low demand. This translated to a decrease in chemical throughput of 8.1%. Biofuel throughput was down, and LNG also remained below the previous year's levels when as much as possible was supplied in the midst of an energy crisis.

The throughput volumes of conventional breakbulk normalised, after a strong post-Covid-19 recovery between spring 2021 and September 2022, to pre-Covid-19 levels. Compared to 2022, total throughput was down 18.8%. Due to a decline in European steel production and lower demand, the handling of steel, the main product group within conventional general cargo, fell by 16.9% with exports (-15.5%) holding up better than imports (-17.9%).

Total roll-on/roll-off traffic held up relatively well with a slight decrease of 2.1%. Throughput of transport equipment (in units) was up thanks to an increase in the throughput of new cars. In 2023, 3.56 million new cars were handled, an annualised growth of 9.0%.

Throughput of unaccompanied cargo (excluding containers) carried on RoRo vessels was also down slightly (-1.5%). Over half of these flows were related to the UK and were down (-4.9%), while traffic related to Ireland was up sharply (+17.9%), and Scandinavia traffic held steady.

The dry bulk segment was down 13.9% on 2022. Demand for coal, which was high in 2022 due to the energy crisis, has since fallen sharply. Fertilisers, which were already down partly due to sanctions against Russia and increased fertiliser prices, were also down further in 2023.

Zeebrugge welcomed 169 cruise ships and 953,048 passenger movements in 2023, making 2023 a record year. A spread of cruises both throughout the year and during the week, ensured a staggered inflow.

In 2023, 20,156 seagoing vessels called at Port of Antwerp-Bruges, a drop of 4.2%. The total gross tonnage of these vessels grew by 2.6% to 657 million GT.

Investing in the future

The ports of Antwerp and Zeebrugge combined to become the Port of Antwerp-Bruges in April 2022.

Over the next 10 years, the port envisages an investment program worth €2.9 billion, including in new infrastructure such as a quay wall for the Europa Terminal, a new coordination centre and residual land on the Left Bank.

The port is actively promoting a circular economy with the implementation of the Warmtenet Antwerpen Noord project. The first delivery of heat will soon take place, and further development of the NextGen District is planned for this year.

To meet the significant demand for renewable energy, the port is not only focusing on local solar and wind energy, but is also strongly committed to importing green energy. This year the port will see the first bunkering of hydrogen and hydrogen carriers, such as methanol.

As part of the greening of the Port of Antwerp-Bruges fleet, two pioneering vessels will be introduced: the Methatug, the world's first methanol-powered tug, and an electric reversed stern drive tug, a first for Europe.

Shore power is being further developed, with work starting on the shore power installation for the cruise terminal in Zeebrugge later this year. Additionally, the port is working with industry on CO2 reduction through CO2 capture. Work on the CCS terminal is expected to start this year, after the investment decision is taken soon.

b, said: "We had seen it coming for some time that 2023 would not be a great year. After all, as a port, we are at the centre of economic and geopolitical challenges. But, with a powerful strategy, the merger and an efficiency exercise, we have managed to organise ourselves in good time and are even gaining market share in the Hamburg-Le Havre range.

“Especially in more turbulent waters, it is essential that, using our strategic plan as a compass, we keep sailing in a focused manner in the right direction. We will therefore continue this in 2024. So as to remain attractive to investors and continue our strategic role as a pioneer. Legal certainty is crucial in this regard. We therefore expect the government to promptly clarify a workable licensing framework and correct conditions to continue to operate as a business and attract investment as a top platform."