Flex LNG Ltd. released its unaudited financial results for the fourth quarter and full year ended December 31, 2024, reporting a robust performance amid a challenging LNG shipping market.

Flex LNG posted vessel operating revenues of $90.9 million for the fourth quarter, a slight increase from $90.5 million in the third quarter. Net income surged to $45.2 million, significantly up from $17.4 million in the previous quarter, translating into basic earnings per share of $0.84 compared to $0.32 in Q3.

The company reported an average Time Charter Equivalent (TCE) rate of $75,319 per day, maintaining stability compared to the $75,426 per day recorded in Q3. Adjusted EBITDA stood at $68.7 million, down slightly from $70.4 million, while adjusted net income rose to $30.8 million from $28.7 million in the prior quarter. The company’s adjusted earnings per share reached $0.57, up from $0.53 in Q3.

Courtesy Flex LNG

Courtesy Flex LNG

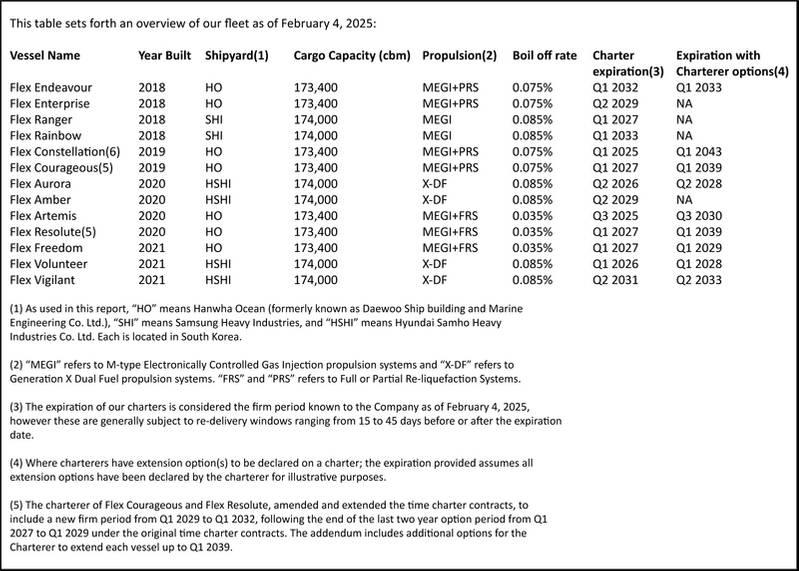

Flex LNG continued to strengthen its balance sheet and secure long-term revenue streams. In Q4, the company closed a $160 million JOLCO lease financing for Flex Endeavour, completing a $430 million financing plan with net proceeds of approximately $97 million. Additionally, the company amended its Flex Enterprise $150 million facility, converting an $83.7 million term loan tranche into a revolving credit facility, increasing its total revolving credit facility to $413.7 million.

The company also secured long-term charter extensions. In November 2024, the charterer of Flex Courageous and Flex Resolute extended existing time charters, adding a firm period from 2029 to 2032, with options to extend up to seven additional years. Furthermore, Flex Constellation secured a 15-year time charter contract with a major Asian utility and LNG trader, commencing between Q1 and Q2 2026 and running until 2041, with options extending to 2043.

CEO Øystein M. Kalleklev expressed confidence in the company’s ability to navigate current market challenges. “We are pleased to deliver a strong financial performance in line with our guidance. Our strategic approach to chartering and balance sheet management ensures we are well insulated from near-term market weakness,” Kalleklev stated.

Despite a challenging short-to-medium-term outlook for LNG shipping, Flex LNG has capitalized on prior market upturns to build a strong financial foundation. The company ended 2024 with $437 million in cash and first debt maturity in 2028. Kalleklev highlighted that the market dynamics from 2024 to 2027 may resemble those of 2014 to 2017, with an expected increase in vessel demolitions potentially improving market conditions from 2027 onwards.