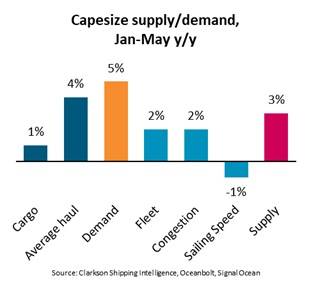

“During the first five months of 2023, demand for Capesize ships increased 5% y/y while supply increased 3% y/y. Nonetheless, spot rate increases remain hesitant, largely due to concerns over China’s fragile economic recovery,” says Filipe Gouveia, Shipping Analyst at BIMCO.

Demand growth was supported by a 4% increase in average haul while cargo volumes increased only marginally. Average haul increased due to higher exports from Brazil and Guinea and higher volumes of long-haul Russian coal.

Supply rose due to a 2% y/y increase in the Capesize fleet and a 1% increase in fleet productivity. Congestion for Capesize ships diminished compared to a year ago, freeing approximately 2% of the fleet while sailing speeds fell on average 1%.

“The improved supply/demand balance has allowed rates to recover from the low levels observed between August 2022 and February 2023. However, over the past week spot rates have once again come under pressure,” says Gouveia.

The Baltic Exchange’s Capesize index fell 58% between its most recent peak on 10 May this year and its most recent low on 2 June. The rapid decline was driven by weaker rates for transatlantic voyages due to low import demand from Europe for coal and iron ore. Rates have since started to recover as ships reposition.

Competition from Panamax ships could also be contributing to weaker Capesize rates. According to the Baltic Exchange’s Panamax 5TC index, earnings are currently under 10,000 USD/day as of 6 June, which is unusually low for this time of year. Given the weak spot rates, larger Panamax ships may compete with smaller Capesize ships for cargo.

On top of these developments, China’s fragile economic recovery might still be the largest obstacle to stronger Capesize rates. In March, economic activity strengthened, but bulk demand indicators have weakened since then. The manufacturing PMI was below 50 in both April and May while the crisis in China’s real estate sector remains unresolved, despite several support measures.

“The Chinese government is currently working on a stimulus package to further aid the real estate sector. If the package is strong enough to drive construction activity, Capesize demand and rates could see some support,” says Gouveia.