There are thousands of vessels worldwide that still need to be fitted with ballast water management systems (BWMS), and regulatory deadlines are only drawing nearer.

Owners and operators who have yet to bring their ships into compliance are better to do so earlier rather than later. This is the advice of classification society ClassNK, who analyzed the retrofitting status of its registered ships and confirmed that installation deadlines based on the Ballast Water Management Convention (BWM Convention) for many of them are highly concentrated in the year 2022.

ClassNK recommends installing early to avoid the difficulties that would come with many around the world waiting until the last minute to install BWMS.

As the end of August 2018, there were 7,315 ships on the ClassNK register obligated to install BWMS in compliance with the BWM Convention, ClassNK said. Of this amount, 1,915 ships have already completed the installation, leaving 5,400 ships that still require attention.

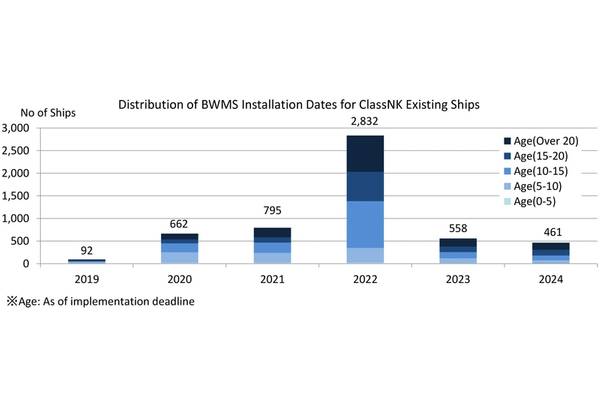

The distribution of BWMS installation deadlines in line with the BWM Convention is as follows: 92 ships by 2019, 662 ships by 2020, 795 ships by 2021, 2,832 ships by 2022, 558 ships by 2023, and 461 ships by 2024, with the majority being highly concentrated in 2022. The classification society noted that the peak figure for 2022 may decrease due to the influence of ship recycling trends and response to USCG regulations.