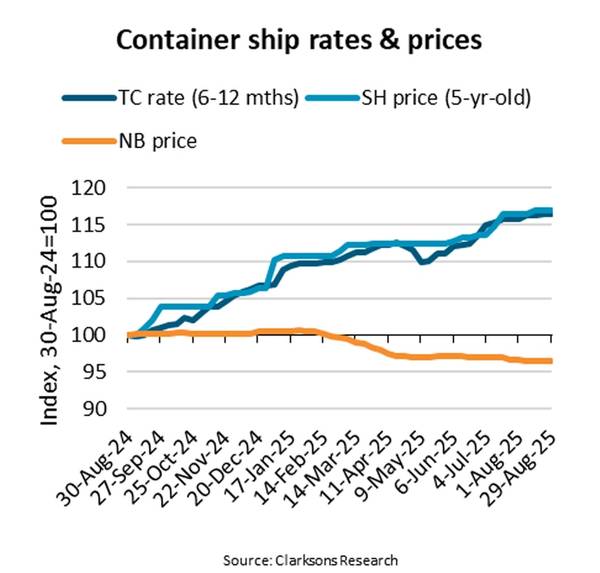

Despite significantly weaker freight rates, the average price for five-year-old container ships has increased 17% year-on-year and 6% since the beginning of 2025,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.

The average per TEU price of a basket of seven five-year-old container ships was $9,761/TEU in late August 2024. Since then, the price has risen to $10,758/TEU at the beginning of 2025 and to $11,413/TEU in late August.

Feeder ships smaller than 3,000 TEU have seen the highest price increase at an average of 26% year-on-year.

“Container spot freight rates for Shanghai exports have dropped 51% since late August 2024 and 42% since the beginning of 2025, according to Shanghai Shipping Exchange. Average freight rates for Chinese exports have similarly fallen 41% year-on-year and 25% since the start of this year,” says Rasmussen.

Global average freight rates have fared better but are still down as market volumes have not been able to keep pace with year-to-date average fleet growth of 8.7% year-on-year.

While freight rates have not supported the price of second-hand ships, time charter rates have. Like prices for five-year-old ships, time charter rates for a 6–12-month period are up 17% year-on-year and 9% year-to-date.

Rates and prices have disconnected as the idle ship capacity percentage has remained below 1% during 2025, according to Alphaliner.

Meanwhile, container ship newbuilding prices have fallen 4% both year-on-year and year-to-date. Accordingly, the average price of five-year-old ships has risen to 80% of the average newbuilding price, the highest relative price since late 2022.

Looking ahead, ships with a total capacity of 2.3 million TEU are scheduled for delivery in 2025 and 2026. Before considering recycling of older ships, that will add 7.2% to the container fleet’s capacity.

“Though great trade uncertainty remains, container volumes appear unlikely to grow as fast as the fleet. Under normal circumstances, we would expect both time charter rates and second-hand prices to eventually begin to fall. However, rates and prices for feeder ships smaller than 3,000 TEU may prove fairly resilient as ships scheduled for delivery before the end of 2026 will only add 2.7% to that segment’s total capacity,” says Rasmussen.