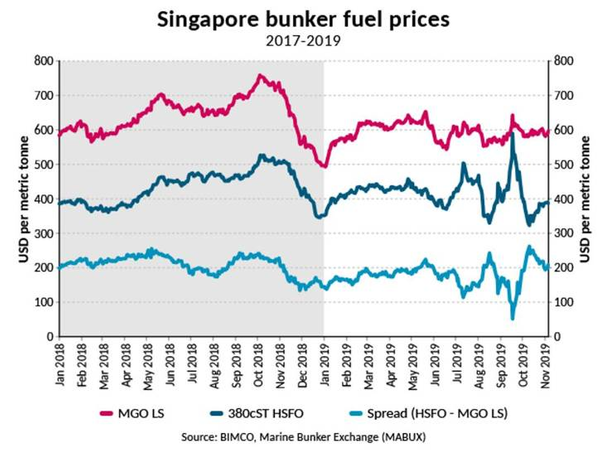

BIMCO members can now monitor the price spread between Marine Gas Oil Low Sulphur and 380 centistoke High Sulphur Fuel Oil in 32 different ports around the world with daily information supplied by MABUX.

The service is intended to assist members in making bunkering decisions before and after January 1, 2020.

“We have seen significant fluctuations in the market over the past couple of months – fluctuations that can only be explained by the massive uncertainty about the future. It is currently not operating by market fundamentals. We hope this tool will provide our members with a helping hand, when making decisions about – for example – bunkering ports,” BIMCO Chief Shipping Market Analyst says.

That said, BIMCO advise members to seek first-hand knowledge of the local bunker markets, for example through port agents, before making any bunkering decisions.

BIMCO launched the interactive bunker pricing tool in October, which allows BIMCO members to closely monitor the bunker fuel oil movements on a daily basis, but only covering Singapore and Rotterdam prices.

Now, an additional 30 ports have been added. New ports include Antwerpen, Hong Kong, the Panama Canal and Pireaus, to name a few.

In the coming months, the BIMCO market analysis team will continue to provide analysis of the bunker market.