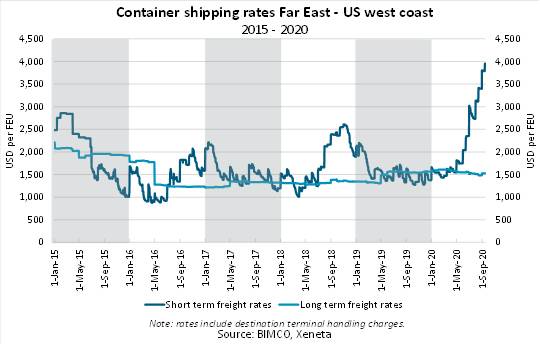

Trans-Pacific short vs long contract freight rate gap hits record $2,400 per FEU

As the year 2020 continues to deliver positive surprises for the container shipping sector, the gap between short and long term contract freight rates on the Trans-Pacific trade lane has never been wider, according to a recent market note from BIMCO, noting that conditions are right for carriers to achieve higher long term contract rates.

On 17 September, for containers shipped from the Far East into the US west coast, short term freight rates stand at $3,921 per FEU and long-term freight rates at $1,521 per FEU - a record difference of $2,400 per FEU, according to Xeneta.

A significant rise in container volumes into the San Pedro Bay ports of Long Beach and Los Angeles on the U.S. west coast, has pushed imports up by 13% and 18% respectively in August, compared to the same month last year. The rise stands in contrast to an average of 17% decline in container volumes in February, March and May this year.

Falling year-to-date volumes aside, a flood of cargoes like the one seen in August, which replaced a full blown drought of transportation demand earlier in the year, certainly brings opportunities.

“Now, more than ever, it is the carriers’ market. Carriers have successfully pushed through eight consecutive general freight rate increases in just five and a half months. The coming weeks and month are likely to see higher long term freight rates when contracts are up for negotiations and renewal with cargo owners and shippers,” Sand concluded.