The backers of a proposed 800-mile (1,287 km) gas pipeline in Alaska championed by U.S. President Donald Trump expect to complete a key engineering and cost study by the end of this year, Interior Secretary Doug Burgum said on Monday.The ambitious proposal to transport gas from Alaska's far north to the Gulf of Alaska has been talked about for decades but has received new impetus under Trump, who has sought to boost U…

ECOnnect Energy has signed two pre-Front End Engineering and Design (pre-FEED) contracts for its IQuay Regas Terminal, a modular floating regasification system designed to offer faster, more flexible alternatives to conventional onshore and floating LNG terminals…

Over the first nine months of this year, cargo throughput at the Port of Klaipėda increased by 11% compared to the same period last year, reaching 28.7 million tons. The largest share of cargo flow consists of container cargo and ro-ro, alongside…

In the first nine months of 2025, Port of Antwerp-Bruges handled 202.6 million tons of maritime goods, a decrease of 3.8% compared with the same period last year. The throughput of general cargo, including containers, conventional general cargo and RoRo…

Poland will seek binding offers for capacity that would be available in the expanded floating liquefied natural gas terminal near Gdansk following ample interest from shippers, the country's gas pipeline operator Gaz-System said on Monday.Gaz…

U.S. LNG exports hit a record in September at 9.4 million metric tons, beating their previous record of 9.3 million MT in August, according to preliminary data from financial firm LSEG.The increase was fueled by strong sales to Europe and Asia…

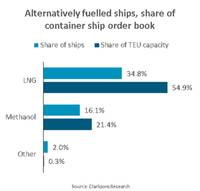

“As of end August 2025, 534 container ships are on order which will be able to use alternative fuels upon delivery. These represent 53% of ships on order and 77% of the TEU,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.In addition to these alternatively-fuelled ships…

Puerto Rico has negotiated a $4 billion LNG contract with New Fortress Energy, Governor Jenniffer Gonzalez said on Tuesday in a post on social media.The supply deal, which comes after talks for a much larger contract broke down in July, reduced…

New insights from DNV’s Maritime Forecast to 2050 indicate that the number of alternative-fuel-capable vessels in operation is set to almost double by 2028.By 2030, the alternative-fuelled fleet will be able to burn up to 50 million tonnes of…

Tanker shipping company Stena Bulk has signed a cooperation agreement with Seasystems AS to expand the global reach of its jettyless LNG infrastructure technologies.Under the partnership, Seasystems will exclusively market, sell, and deliver…