Global trade flows have adjusted to new geopolitical developments last week, with Red Sea diversions maintaining their grip on vessel demand patterns. Against this backdrop, timecharter earnings hit their highest levels since October 2024, with Capesize rates leading the rally while smaller segments lagged behind. The S&P market saw continued interest in modern tonnage as owners position for tightening supply fundamentals.

Values for 5YO Capesizes of 180,000 DWT have rallied impressively this year, up by c.23% since the start of the year from USD 55.18 mil to USD 67.73 mil – the strongest levels we have seen since October 2008.

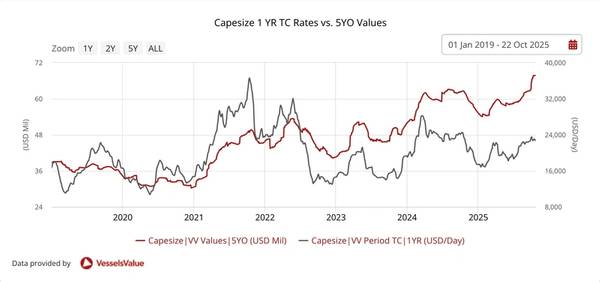

What’s interesting though is the disconnect between asset values and earnings when comparing 5 YO Capesize vessels with one year TC rates. Using VesselsValue’s Timeseries solution, there is a clear disparity between the two curves. While values are soaring, the earnings picture is more modest. One-year TC rates started the year at 17,432 USD/day and reached 23,067 USD/day in mid-October – a decent 33% gain but not quite matching the asset price momentum.

China’s state-owned iron ore buyer temporarily pulled back from BHP purchases in late September over pricing rows, but the two sides hammered out a deal by early October. BHP agreed to settle 30% of its spot ore trades with China, effective Q4 2025. The dispute underscored Beijing’s growing clout through centralised procurement mechanisms, though the swift resolution meant limited disruption to ton-mile demand on Australia-China routes.

Complicating the outlook, fresh Chinese port fee adjustments are reshaping routing economics, with increased charges at major discharge ports potentially diverting additional tonnage away from traditional Chinese hubs and creating secondary effects across regional utilization patterns.

On the demand front, it’s not just about iron ore anymore. Guinea bauxite is increasingly taking tonnage that coal used to fill on Capes, with more coal now moving down to Panamaxes. This cargo reshuffling is having ripple effects across the entire Bulker spectrum.

The transactional side shows a notable slowdown. S&P activity is down 27% year-on-yearjust 104 deals in the first nine months versus 142 last year. Newbuilding orders have also dipped slightly, down 5% from 67 deals to 64. With asset values at multi-year highs but deal flow retreating, it suggests potential buyers are either waiting for a correction or reassessing the risk-reward at current price levels. Notable recent sales include Capesize BC (Newcastlemax) Mineral Cloudbreak (205,100 DWT, Jul 2012, Hanjin Subic) sold to unknown Hong Kong, China buyer for USD 39 mil, VV Value USD 38.53 mil.

Chinese buyers have maintained a significant presence in the Capesize S&P market this year, accounting for just over a quarter of purchases at approximately 26%. Transaction activity peaked in February with 22 sales, representing the busiest month of the year, though the market has sustained a steady stream of deals since then. Vessels sold have averaged 14 years of age, indicating continued appetite for mid-age tonnage in the current market.

Market sentiment reflects cautious optimism as supply-side discipline meets resilient cargo demand. Owners with modern, compliant tonnage continue to command premium rates, while demolition candidates face narrowing windows for profitable exit strategies. The coming weeks will be critical in establishing whether current rate levels represent a sustainable floor or merely a temporary plateau.