Maritime Advisors, Liengaard & Roschmann have published for the third year running its Vesselindex Performance Report, ranking the listed dry bulk companies based on their TCE performance.

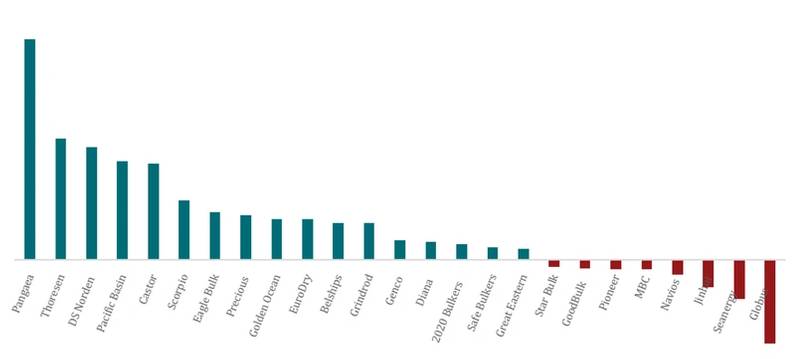

In a year 2020 which was characterized by a high level of volatility it is noticeable that 17 companies managed to outperform the general market as defined by the Baltic Indices. U.S. listed Pangaea Logistics claims top spot for the third year in a row, competing against 24 other listed Dry Bulk companies on their Time Charter Earnings (TCE) for 2020.

The Vesselindex Performance Report is relevant as it measures the TCE performance of Dry Bulk companies in relation to the earning potential of their respective fleets. In this way, it is ensured that no company harvests the benefits from a superior fleet composition, nor getting penalized for the opposite. Around 900 vessels across more than 150 different vessel designs are covered within the report. Each vessel has been assigned an index using the online platform Vesselindex.com and have been assessed from a naval architecture viewpoint considering the speed/consumption performance.

In this year’s report, Pangaea maintains their spot at the top of the ranking, outperforming the market by more than 50%. Other well-known companies such as DS Norden, Eagle Bulk, Pacific Basin and Thoresen Thai find themselves in the top end as well, together with newcomer Castor Maritime who has advanced significantly, jumping 10 spots compared with last year’s performance.

Notable is also the performance of Scorpio Bulkers Inc. (now Eniti). Scorpio who is exiting Dry Bulk and have been selling out their fleet during the second half of 2020, have managed to keep focus on the day-to-day activities, claiming a 6th place in this year’s report.

The average outperformance of the 25 companies rose to 7.5%, up from 6.4% the year before.

* Relative Time Charter Earnings vs. Baltic Exchange Indices 2020. Source: Liengaard & Roschmann

* Relative Time Charter Earnings vs. Baltic Exchange Indices 2020. Source: Liengaard & Roschmann