“In 2024, new crude oil tanker deliveries dropped to a 36-year low as only 17 new tankers, with a capacity of 2.5m deadweight tonnes (DWT), joined the fleet. Compared to 2023, the capacity delivered dropped by 74%,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.

During the year, the recycling of crude tankers increased to 1.7m DWT wherefore the fleet ended only 0.2% larger in 2024 than at the end of 2023, the slowest growth in 23 years.

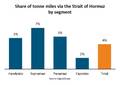

The Aframax and Suezmax segments saw capacity growth of 0.5% and 1.1% respectively. However, the capacity of the VLCC segment fell by 0.2% as two ships were recycled, and no new ships were delivered.

“Deliveries and fleet growth ended at multi-year lows as contracting in 2022 fell to only 3.2m DWT, 83% lower than the last 10 years’ average. This is despite Russian sanctions leading to longer voyages which contributed to a substantial rise in earnings during 2022,” says Rasmussen.

Combined with low levels of recycling during the past couple of years, the minimal addition of new tonnage has driven the average age of crude tankers up to 12.8 years, the highest in 26 years.

Consequently, 19% of crude tankers are now 20 years old or older and contribute 18% of crude tanker capacity, making them prime candidates for recycling in the coming years unless they are kept operating as part of the parallel fleet.

Following the exceptionally low activity in 2022, contracting of new ships rebounded in 2023 and 2024. The order book/fleet ratio has therefore climbed from a low of 2.8% in early 2023 to 10.4% at the start of 2025.

The order book extends into 2028 and could add an average of 2.5% capacity per year to the fleet during the next four years. As global oil demand growth is slowing, fleet growth should be able to match demand growth even if recycling of the oldest ships accelerates.

Not only would the average age of the crude tanker fleet fall but the fleet renewal would also help decarbonise the fleet. Currently, only 3.6% of crude tankers can use alternative fuels while 2.7% are readied for a later retrofit. According to the order book, 18% of ships to be delivered will be able to use alternative fuels while 29% will be readied for easier retrofit.

“Low deliveries and recycling of ships have caused the crude tanker fleet to age considerably. Higher newbuild contracting during the last two years, however, can accelerate both the renewal and decarbonisation of the fleet in the coming years, especially if the oldest ships are recycled at the same time,” says Rasmussen.