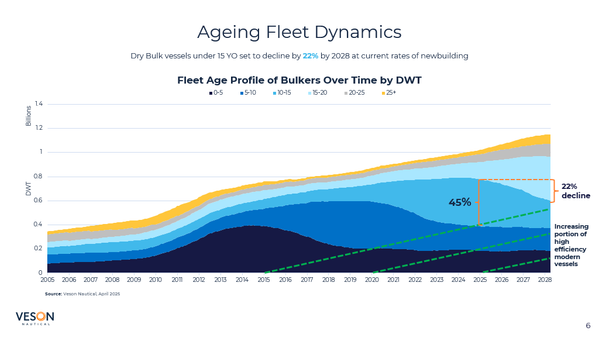

The global dry bulk fleet is facing a sharp contraction in younger, more efficient tonnage, with the supply of vessels under 15 years of age projected to fall by 22% by 2028, according to new analysis shared by Oliver Kirkham, Senior Valuation Analyst at Veson Nautical, a global leader in maritime freight and fleet management solutions.

Speaking at the 2025 Marine Money Week in New York, Kirkham told delegates that the anticipated drop in younger dry bulk tonnage reflects a structural shift brought on by the historical imbalance in newbuilding activity, combined with a maturing fleet that is increasingly ill-equipped to meet modern efficiency and emissions standards.

“We’re seeing a clear bifurcation in the fleet,” Kirkham said. “On one side, you have a rising share of modern, regulation-compliant vessels while on the other, a large and aging cohort that’s slower, less efficient, and increasingly penalised by emissions rules. That divergence is only going to widen over the next five years.”

Kirkham added that the commercial advantage of younger vessels is likely to be enhanced by a wave of scrapping, as regulatory and commercial pressures converge on the ageing bulk fleet. A growing number of ships are approaching their third special survey at a time when environmental rules are tightening, and dry dock availability is becoming increasingly constrained owners are facing a choice between expensive upgrades or resigning older vessels to less profitable trades which may become oversupplied with tonnage.

With younger vessels increasingly favoured for long-term charters and ESG-aligned trading, Kirkham said the stratification of the fleet is already shaping commercial outcomes. Modern ships are commanding premium rates and attracting interest from larger commodity traders and publicly listed operators, while older tonnage is becoming increasingly concentrated on shorter regional trades, often operating in jurisdictions with looser regulatory oversight.

Looking ahead, Kirkham said tightening supply dynamics - driven by scrapping, fleet ageing, and regulatory evolution - are likely to play a defining role in shaping market opportunities over the coming years.

“As the industry transitions toward a leaner, more efficient fleet, stakeholders need to embrace a more data-driven mindset,” Kirkham concluded. “We’re entering a cycle where the winners will be those with the clearest view.”