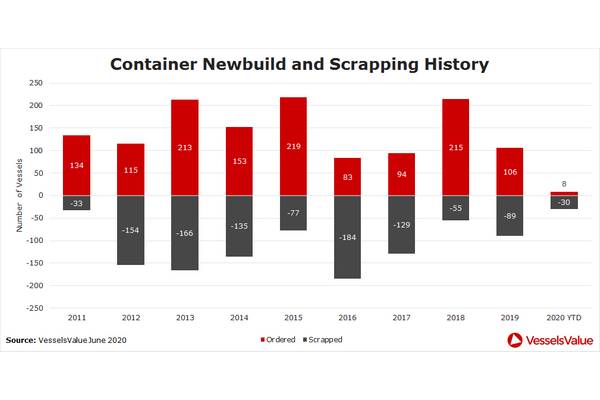

The only orders to be placed since the beginning of the year are from OOCL and Great Horse China for a combination of 7 ULCV’s ranging in size. This is a drop of 86% compared to this time last year and can only be due to the Covid-19 outbreak.

As the global lockdown intensified through March, rates and values across all sizes fell. We have seen the larger 8,500 TEU tonnage earnings fall by c.40% since the start of the year which has bought values down a considerable amount. Container traffic out of the East picked up from the end of March as the situation in Asia, particularly China, started improving. However, the escalation of disruption in Europe and the US and the related fall in consumer activity caused Containership journeys in the west to fall off at the end of March. Considering the extent of disruption to earnings and ton mile demand, we only saw sales fall by c.20% compared to YTD 2019 with the majority taking place at the beginning of the year.

The scrapping market has remained relatively stagnant and has been impartial to the closing of the sub-continents. Although steel plate prices feel by over 20% in the space of 3 months, we have started seeing the Container markets in the sub-continent open up again.