Newbuilding

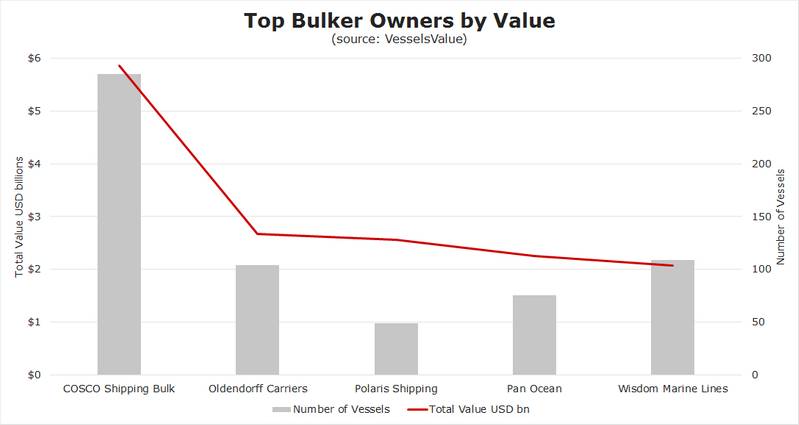

Many Chinese companies have been stepping up in the bulker market with COSCO Shipping and Avic leasing placing orders at Chinese yards. Of the total 313 Bulkers ordered over the past year, nearly 40% have been Panamax vessels, demonstrating the hot market.

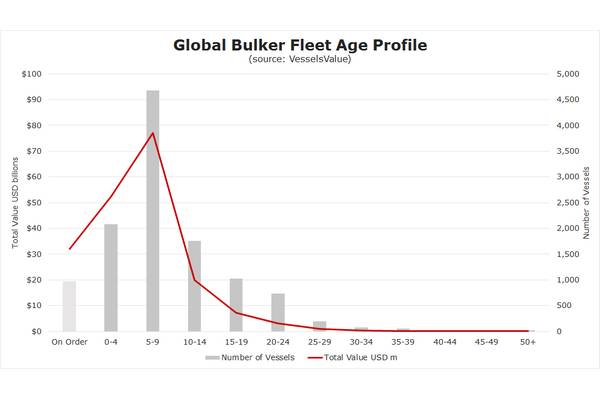

Source: Vessels Value

Source: Vessels Value

Second hand market

The Bulker market as a whole has shown a softening in values over the past year. The main reason for this is due to the drop off in rates throughout the first quarter of 2019.

In particular, the Capesize market suffered a substantial amount over the spring months with rates reaching three-year lows. This was represented in the sale and purchase market with a break of 110 days when no deals were confirmed. A break of this length has never been seen in the market before. Having said this, we have recently seen an unusual sale of an ore carrier, the Pacific Glory, for $14.6 million offloaded by MOL.

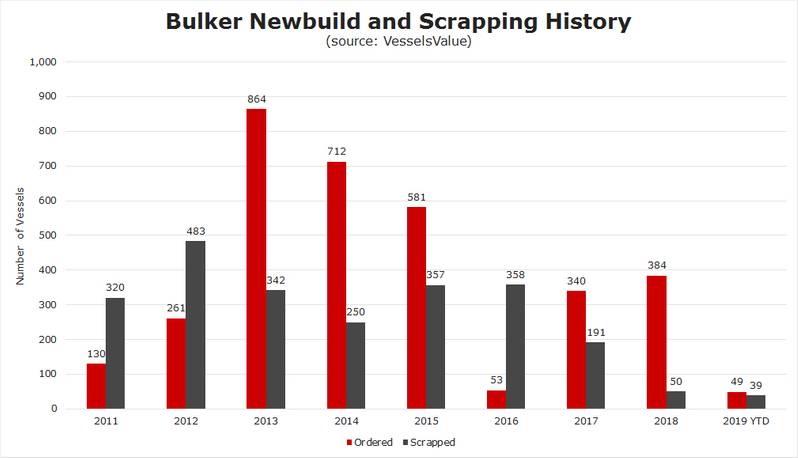

Demolition

To contrast the limited activity in the S&P market, 20 Capesize vessels have been confirmed for demolition since January 2019, mostly with delivery to Bangladesh. This compares to a total of 17 vessels that were sold for demolition throughout the whole of 2018 making them the most popular bulker to be scrapped.

Source: Vessels Value

Source: Vessels Value