Cruise Lines shrug off tragedy, bad publicity, new regulations and a weak economy to post impressive growth.

In the year since the Costa Concordia tragedy, the cruise industry has seen a raft of new regulatory initiatives; in part developed in conjunction with industry associations. Harmonization of multiple regimes is the new mantra for industry stake-holders. In late December, the Florida-based Cruise Line Industry Association (CLIA) announced a tie-up which will result in one worldwide voice for the industry. This development parallels efforts at the IMO, where unified policies regarding lifeboat muster drills are expected to be incorporated into SOLAS; they would come into force in mid 2014. Additionally, the IMO’s Maritime Safety Committee agreed to add measures developed in conjunction with industry to its Guidelines on Passenger Ship Safety.

Meanwhile, the technically innovative but painstaking salvage effort at Giglio, where the vessel grounded off the Tuscan coast, by Titan Salvage and an Italian partner, is continuing. If all goes according to plan, the Costa Concordia, righted in a complex operation and then refloated, would be towed to a yard for scrapping in the summer of 2013. No matter how competently carried out the salvage operation, however, the entire episode reflected badly on an industry that promotes maritime driven fun and safety.

Perceived Fear; Some Growth Instead

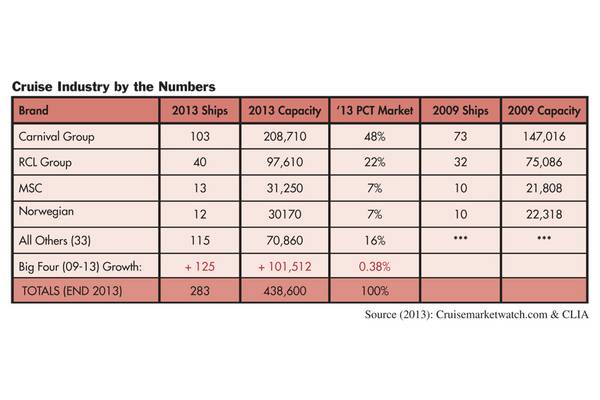

In the wake of the January 2012 tragedy, there were fears that travelers’ fears would keep the passengers away from cruises. In an enviable success story, and against the backdrop of a less than rosy worldwide economy, the industry that had grown by 7.5% annually from 1980 through 2011 (according to statistics from the CLIA), managed to engineer a major growth spurt occurring in 2010 and 2011 alone – when total passengers carried exceeded 16 million.

In mid-August, 2012, CLIA’s President and CEO, Christine Duffy, told the travel industry pres, “I think that people understand that what happened with the Costa Concordia tragedy was an isolated event … and … is not a systemic issue or problem.” When asked about bookings, she suggested that a sampling of CLIA-affiliated travel agents were seeing a year over year increase in bookings.

Reports from large cruiseship owners bear out what CLIA’s Duffy described as admittedly “…anecdotal evidence…” at that time. At the end of November, 2012, and as Costa Cruises’ parent company, Carnival Corporation was raising US $500 million in 5 year notes, the rating agency Standard & Poors pointed to general economic malaise as a concern. S & P explained: “We believe that the cruise sector has, to a large extent, recovered from the impact of the Costa Concordia grounding and should experience a low-single digit next yield growth in 2013, although the Eurozone recession remains a key risk factor.” The S&P report added that both Royal Caribbean and NCL Corporation (who round out the “Top Three” in the industry’s league tables) “… have reported that 2013 fleet-wide bookings are pricing higher compared to this year’s (2012) bookings, and pricing remains strong across the industry for Caribbean itineraries.

The companies themselves have offered upbeat expectations, buttressed by the predominant position of the relatively stronger Caribbean segments compared to the more troublesome European businesses. On Carnival’s late December 2012 conference call with investment analysts, its Chairman, Micky Arison, told investors, “I think we’ve been consistent in saying that recovery at Costa is not a one-year issue. It’s going to be multiple years. And we’re forecasting a recovery of about half the yield deterioration.” In its previous quarter, Carnival’s earnings release had explained that, “For the remainder of the year and first half of 2013, cumulative advance bookings excluding Costa are still behind the prior year at slightly lower prices. For Costa, cumulative advance bookings have shown considerable improvement but are still five occupancy points behind the prior year at lower prices over the same period.” Costa is important for Carnival, but it is also part of a diversified portfolio. For 2013, Carnival was forecasting that its business program was expected to be 19% in the Mediterranean, and 12% in Europe (outside the Med). By mid 2013, two Costa vessels (Costa Atlantica and Costa Victoria) were expected to be deployed in the burgeoning Asian markets, offering Southeast Asian itineraries.

Royal Caribbean, ranked behind Carnival, also noted the impact of the Costa Concordia. RCL’s Chairman and CEO, Richard Fain, told investors on its Q3 2012 conference call, “…we are still navigating an environment overshadowed by severe political and economic turmoil and the tail of the Costa Concordia effect.” Mr. Fain, speaking to investors in late October, 2012, added, “The European market though continues to be the most puzzling market we’re facing. The impact of the tragedy in Italy was obviously centered in Europe. Now that impact does continue to wane, but some of the effects still linger, and we continue to learn and be proactive in trying to recover from it.”

Headwinds

The bottom line, looking back, is that the cruise sector did see headwinds from last January’s accident (ominously, on Friday the 13th), but also from Europe’s economic downturn. RCL’s Fain, responding to an analyst question about the likely improvement in his company’s yield, answered, in part: “…we’ve effectively raised it back to the original forecast of around 3%. It’s difficult for us to really pinpoint how much of that was due to the (Costa Concordia) incident, how much of that was due to a softer European economy.” Yet, RCL was telegraphing full speed ahead during 2012’s final week, when it announced an order for a third “Oasis” class 5,400 passenger vessel, to be delivered from STX France (in a switch from STX Finland - which built the two prior vessels) in 2016 at an undisclosed price, but presumed to exceed $1 billion.

Separately, in mid January 2013, private equity firms TPG and Apollo, along with an Asian cruise operator Genting, were able to float off a $446 million chunk of their investments in Norwegian Cruise Line Holdings (the parent of Norwegian Cruise Lines, or NCL). Genting is the parent of Star Cruises, owner of NCL prior to Apollo’s original 2007 investment in the sector. A previous attempt at an IPO, in late 2010, had foundered, but investors’ appetite changed dramatically by early 2013. Within the requisite risk disclosures within the lengthy prospectus, there is no mention of Costa Concordia specifically, though one section notes the potential for “Adverse incidents involving cruise ships” could negatively impact customer perceptions - as well as insurance availability and premiums.

The positive tailwind behind the Cruise sector, a year after last year’s accident, can be felt from an S&P rating opinion, regarding NCL’s credit ratings (on debt) issued as the IPO road shows were beginning. S&P’s positive outlook, portending likely improvements in the company credit rating (from “B+” to the slightly better “BB-“) and upticks in ratings of individual notes outstanding, was predicated on IPO proceeds being used to pay down debt. As NCL’s multi-year deleveraging program moves forward, less debt translates into less financial risk. In its review of NCL, S&P also reiterated its forecast of a likely industry recovery and its forecast for renewed growth after a sluggish 2012.

Though explicit business forecasts are not provided in the Norwegian Cruise prospectus, the company opines, “We believe that improving leisure travel trends along with a relatively low supply outlook in the near term from the Major North American Cruise Brands lead to an attractive business environment for our Company to operate in.” It also points out that, for North Atlantic players, Europe’s low market penetration provides a big upside, with the European vacation market cited as the “…fastest growing…” leisure segment globally.

The View From ‘Cruise Central’

From the vantage point at the Port of Miami, where voyages for most of the cruise majors originate, the outlook is bright. Paula Musto, Director of Public Affairs at the cruising hub, told Maritime Professional, “Port Miami is looking forward to a strong 2013 cruise season with its largest expansion ever of new cruise brands and new build vessels. The parade of new cruise ships began with the arrival of Regent Seven Seas Cruises which re-located to Port Miami from Port Everglades last fall.” Ms. Musto ticked off a list of additional successes for the 2013 cruising season: “Disney Cruise Lines’ Disney Wonder, will make Port Miami Disney’s second homeport in the State of Florida. We will also be attracting Carnival Cruise Lines’ newest and largest ship, the Carnival Breeze, Oceania Cruises’ newest ship, the Oceania Riviera and Celebrity Cruise Lines’ newest ship, the Celebrity Reflection. In late 2013, MSC Cruises will begin sailing from Port Miami when the upscale European line brings its newest ship, the MSC Divina, to Miami.”

The anniversary of last year’s Costa Concordia has passed. Terrible and tragic as it was, the accident has nevertheless moved out of the popular psyche. This is evidenced by the enormous success of the NCL stock offering, which was sold at $19/share, actually $1/ share above the range anticipated by bankers. In early trading, it rose as high as $26/share, before backing down. By late in the year, passengers on both newly delivering ships (including those that will call at Miami) and existing vessels will all be benefitting from the new SOLAS rules (even in advance of when they officially enter into force), likely with little thought of the terrible disaster which spawned them.

As this edition of MarPro went to print, all manners of media outlets were all abuzz with reports of another mishap, this time involving a Carnival vessel. The travails of passengers aboard Carnival Triumph, graphically depicted with smart-phone videos (sewage and all), were absolutely front page material. Carnival itself seemed to be in full PR damage control mode against an onslaught of social media reporting and the possible lawsuits that could soon follow. Nevertheless and at the end of the day, cruise ship bookings were doing fine, more than one year after Costa Concordia – a true maritime “disaster” and far worse than Carnival Triumph. In the most recent incident, nobody was killed.

A year from now, in early 2014, it’s likely that the business will be riding further upward on its growth trend. For the cruise industry itself, it has been a time of lessons learned and later applied, which in part have made the rebound possible. Combined with a slowly improving economy and the positioning of new and existing assets in the right markets, Cruise Lines are confidently moving forward on all fronts; full speed ahead.

(As published in the 1Q edition of Maritime Professional - www.marinelink.com)