"In 2025, seaborne coal shipments to China fell 10% as domestics supply increased and demand from steel manufacturing and electricity generation weakened. The decline affected shipments out of Indonesia, the US, Australia and Colombia in particular,” says Filipe Gouveia, Shipping Analysis Manager at BIMCO.

China is the world’s largest importer of coal and the destination of 28% of seaborne coal shipments, which account for 4% of dry bulk tonne mile demand. Thermal coal, which is used for electricity generation, accounts for 87% of seaborne coal shipments to China while the remaining 13% is coking coal used in the production of new steel.

In 2025, 90% of seaborne shipments came from Indonesia, Australia and Russia. Indonesia primarily supplies thermal coal while Australia and Russia supply a mix of thermal and coking coal. China also imports significant volumes of coal via land routes from Mongolia and Russia.

“The drop in coal shipments to China negatively impacted the dry bulk market as tonne miles for coal heading to China decreased 21%. On top of the weaker cargo volumes, average sailing distances shortened as shipments from the US and Colombia fell 70% and 80% respectively. These cargoes faced stiff price competition from Asian suppliers while an increase in tariffs on US coal further discouraged purchasing,” says Gouveia.

The capesize and supramax segments were most impacted by weaker coal shipments into China, as their coal tonne mile demand fell 44% and 19% respectively. Both segments faced tough competition from the panamax segment, while capesize tonne miles were especially impacted by weaker shipments of Colombian coal. Coal volumes on panamax ships only declined 1% but the tonne miles fell 8% due to weaker shipments out of the US.

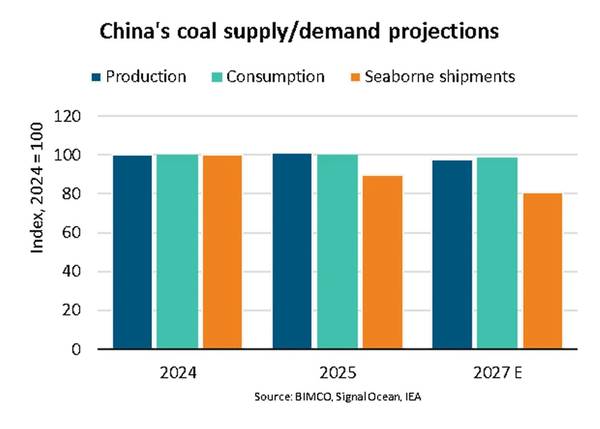

The International Energy Agency (IEA) projects Chinese coal demand to fall 1% between 2025 and 2027, affecting both thermal and coking coal. The agency estimates that China’s installed renewable energy capacity will nearly triple between 2025 and 2030, which would meet or even surpass the country’s growing electricity demand. Furthermore, the World Steel Association forecasts Chinese steel demand to fall 1% in 2026, while the Chinese government is aiming to reduce steel production to tackle the sector’s overcapacity.

Total Chinese coal supply is forecast by the IEA to fall faster than demand due to oversupply in 2025 which has pressured prices and boosted inventories. Between 2025 and 2027, the agency estimates a 4% reduction in Chinese production, the first decline since 2016.

“The IEA forecasts that total Chinese coal imports will drop 8% amid stable overland imports of Mongolian coal, implying 10% lower seaborne coal shipments to China in 2027 compared with 2025. The severeness of the decline will ultimately hinge on how much China’s government will rein in domestic mining,” says Gouveia.