The freight derivatives markets for both tankers and dry cargo vessels saw increased traded volumes in 2020, according to data released by the Baltic Exchange.

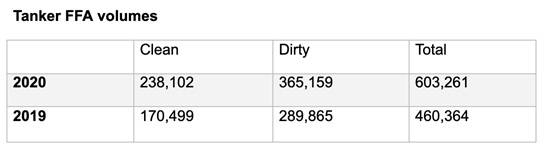

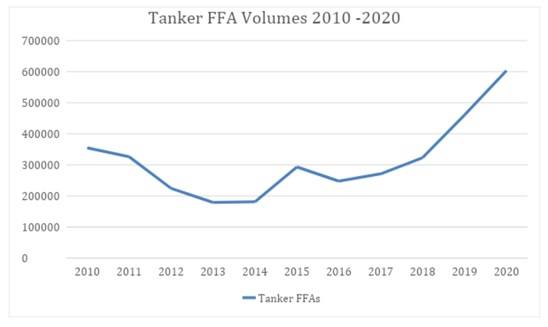

Tanker Forward Freight Agreement (FFA) volumes were up 31% on the previous year, reaching 603,261 lots, with a daily record of 33,677 lots achieved on March 16 at a time when Time Charter Equivalent earnings for very large crude carriers (VLCC) exceeded $275,000.

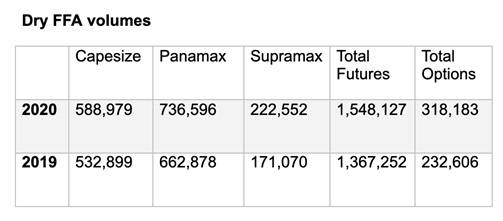

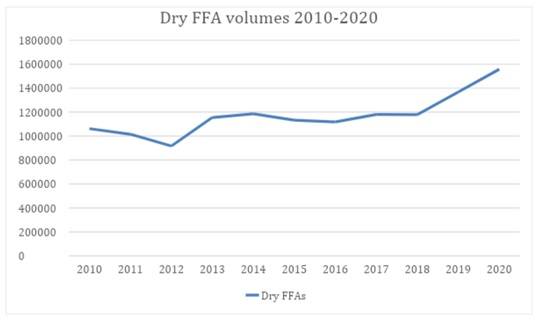

Dry FFA volumes hit 1,548,127 lots, up 17% on 2019. Options trading in the dry market hit an all-time high, up 37% on the previous year to 318,183.

One lot is defined as a day’s hire of a vessel or 1,000 metric tons of ocean transportation of cargo.

Commenting on the figures, Baltic Exchange Chief Executive Mark Jackson said, "2020 was another impressive year for the freight derivatives market. Underpinning these volumes are volatile, trust in the Baltic Exchange’s settlement data and increased participation by owners, charterers and traders. Last year both the dry bulk and tanker markets experienced big swings amid the IMO 2020 fuel change, collapse in oil price and COVID-19 pandemic. The previous 12 months saw 1.5 million dry FFAs traded, representing growth of around 70% since 2012."