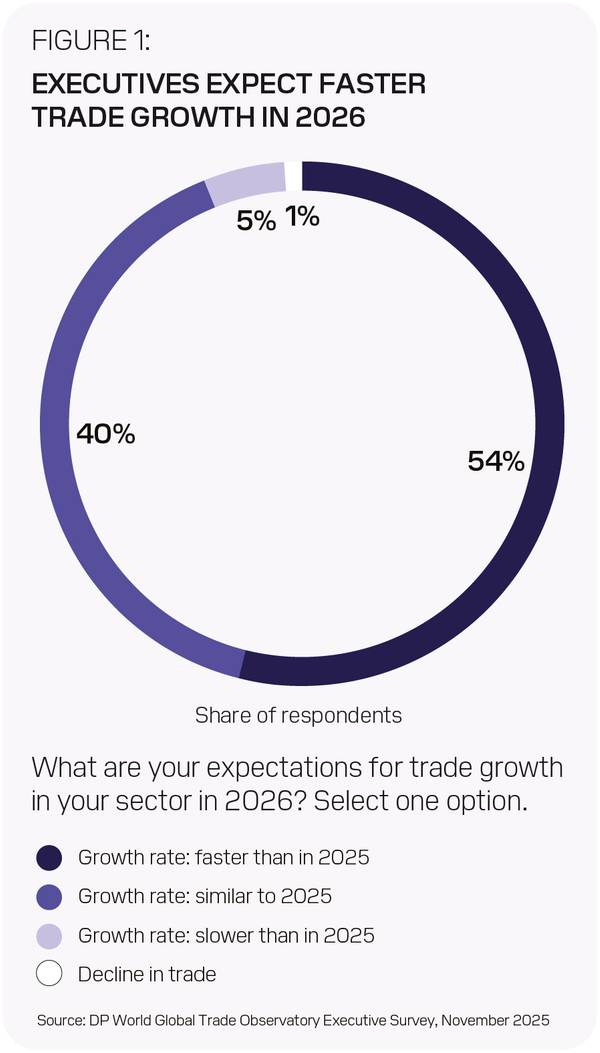

The core finding of DP World’s new Global Trade Observatory (GTO) Annual Outlook Report 2026 is that while global trade outlook looks fragile, business confidence does not. Ninety-four percent of respondents expect 2026 trade growth to match or exceed the pace of 2025, despite rising frictions and volatility.

The findings are based on a survey of 3,500 senior supply chain and logistics executives across eight industries and 19 countries, conducted ahead of the World Economic Forum Annual Meeting in Davos.

In total, 54% expect trade growth to be faster than 2025 and 40% expect it to be equal. This is despite 53% anticipating high or very high policy uncertainty, 90% expecting trade barriers to rise or remain unchanged. Only 25% expect a negative impact on their business, with 49% expecting no effect and 26% even seeing a positive impact.

This frontline sentiment contrasts with some macro projections, with the IMF forecasting trade growth (by volume) could slow to 2.3% in 2026, down from an estimated 3.6% in 2025.

Asked where trade growth potential is greatest in 2026, executives most frequently pointed to Europe (22%) and China (17%), followed by Asia Pacific (14%) and North America (13%).

“Global trade is becoming increasingly complex, not less so. Our role is clear: to keep trade moving by understanding where friction exists, anticipating where it may emerge next, and investing in the infrastructure, capabilities and partnerships that help our customers operate more efficiently and reliably," said Sultan Ahmed bin Sulayem, Group Chairman and CEO of DP World.

The GTO Annual Outlook was developed with Geneva-based insights agency, Horizon Group. “What we’re seeing is confidence with contingency plans," said Margareta Drzeniek, Managing Partner, Horizon Group. "Executives are embedding resilience into strategy by diversifying suppliers, reassessing routes and adding options, because volatility is now the baseline. Those best positioned will be the ones who can turn those resilience plans into measurable performance.”

The survey indicates companies are responding to volatility by actively redesigning supply chains and trade routes. This includes:

© DP World

© DP World