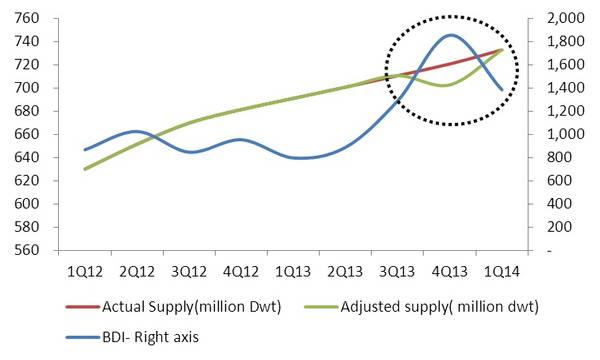

Drewry’s latest Dry Bulk Forecaster saw freight rates on most routes declined in 2014’s first quarter as the previous quarter’s tonnage supply crunch eased out. The fourth quarter of 2013 proved to be an exception as rates surged despite modest demand on account of tonnage supply crisis resulting from bankruptcy-related issues with some dry bulk shipowners.

The operating fleet, having contracted in 4Q13, regained its lost ground as vessels, which were unavailable due to bankruptcy -related issues, returned to service in 1Q14. The protracted low earnings for past few years have resulted in financial distress for many owners. Some of them such as TMT, STX and Excel, got trapped into earnings deadlock and were forced to file for Chapter 11 bankruptcy protection. The legal muddle resulting out of bankruptcy related issues forced charterers to shy away from hiring these vessels and the unavailability of many Dry Bulk vessels created a short term supply crunch in the market which helped rates increase.

Whilst the first quarter of this year has seen demand pick up to new highs, rates could go down as vessels from these distressed owners become available for chartering, supply will go up once again putting pressure on freight rates. Despite the short term pressure, the Dry Bulk market is expected to improve by last quarter of this year as global demand improves further and increase in overall supply slows down.

“Dry Bulk Forecaster” is a quarterly report published by Drewry Maritime Research and is priced at £2075.

The report will be available from the Drewry website www.drewry.co.uk.