London P&I Club Reports Increased Free Reserves

Posted by Michelle Howard

May 12, 2016

The London P&I Club’s result for the 2015/2016 financial year produced an overall operating surplus of $3.3 million, lifting the free reserve to $160.7 million. This result was underpinned by a technical underwriting surplus of $15.3 million, with the combined ratio standing at 82.5 percent.

In a circular summarizing the result, the club’s management team says there was a substantially improved claims outturn following the unusually adverse experience seen in 2014/15. The club’s annual report will be released as usual in July and will contain further details of developments, including particular reductions seen in the costs of claims in the high severity and attritional retained layers, together with positive developments in the cost of older policy years. The cost of International Group Pool claims notified by other clubs, meanwhile, was in line with expectations.

For the first time since 2008/2009, the club recorded a negative return on its investments, amounting to 2.5 percent, or $11.5 million, a position which has been reversed since the year-end.

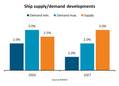

Moving into the current P&I policy year, the club, which this year celebrates its 150th anniversary, saw further steady growth from existing and new members in its owners’ entry and a year-on-year increase of about 600,000gt following the 20 February renewal. There was also growth in its charterers’ book of business, including the addition of a number of European and Far East-based operators.