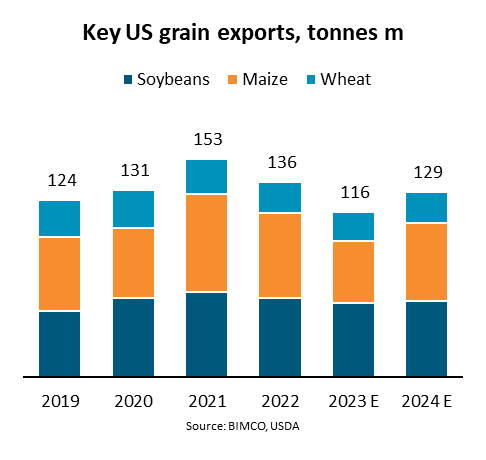

“US soybean, maize, and wheat exports could fall 15% in 2023 due to droughts that affected harvests last year. However, the upcoming maize harvest may drive a recovery in US grain shipments from the fourth quarter onwards,” says Filipe Gouveia, Shipping Analyst at BIMCO.

According to the US Department of Agriculture (USDA), the 2022 soybean and maize harvests were affected by drought which caused a 4% and 9% y/y decline in volume respectively.

As the second largest soybean and maize exporter, the US has a significant impact on global supplies. While the loss of US soybeans has been compensated by a large harvest in Brazil, replacing US maize has been more challenging. Argentina’s 2023 maize harvest was also affected by drought, and the war in Ukraine limited both the size of the country’s harvest and its ability to export it.

“In the first seven months of 2023, global grain shipments are estimated to be down 4% y/y. This has contributed to a deterioration of panamax spot rates, as grains account for 23% of panamax cargo,” says Gouveia.

The Baltic Exchange’s Panamax Index is at an average of 1,028 points so far in July. This is uncharacteristically low for this time of year, marking the worst July for panamax earnings since 2016. However, as shipments of a record Brazilian maize harvest ramp up this month, rates could improve.

In addition to higher Brazilian maize shipments, a pick-up in shipments out of the US is expected in the fourth quarter, which could further support rates. The USDA estimates a 1% and 12% y/y increase in volume for the 2023 soybean and maize harvests respectively.

Despite the positive outlook, downside risks for US grains remain. In its latest update, the USDA revised its estimate downwards for the soybean harvest due to dryness in the Midwest. If unfavorable weather persists, further crop loss could occur. Logistical challenges could also emerge if the water levels in the Mississippi River continue to drop, as 60% of US seaborne grain exports are loaded in ports at the river’s mouth.

“US grain exports could increase 12% in 2024, led by a rebound in maize exports. This should help ensure sufficient global maize supplies and mitigate losses resulting from the war in Ukraine and, for now, the end of the Black Sea grain agreement,” says Gouveia.