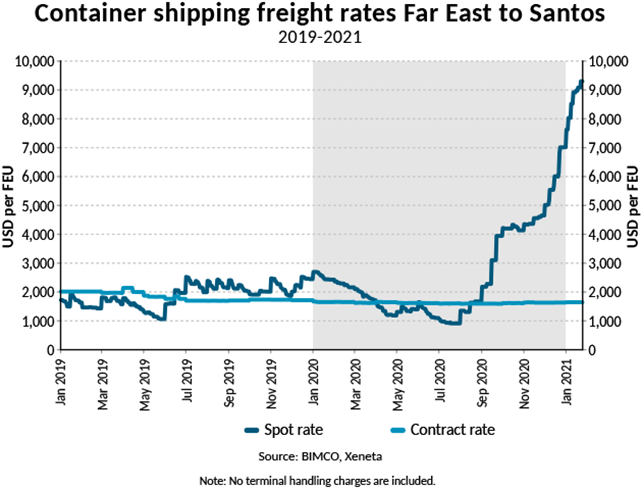

What started as a red-hot container market for Far East to U.S. trades has now spread to other routes, with rates from the Far East to Brazil seeing particularly high spot rates, BIMCO says. On January 24, 2021, the base freight rate for a forty-foot container from the Far East to the Port of Santos reached $9,299. Average rates for January are now 230.5% higher than they were in January 2020.

Santos is the largest container port in South America, handling 4.2 million TEU in 2019 alone.

The red-hot spot market is a result of the imbalance of trade over the past year; the first half of 2020 was marked by blanked sailings and weak demand for container shipping. Towards the end of the year, this was flipped on its head, with demand surging as consumers started spending more money on goods than services. The demand for ships has now surged, with the idle fleet falling below 250,000 TEU, less than one tenth of what it was in May 2020, according to Alphaliner.

In contrast to the high spot rates, contract rates between the Far East and Brazil have been very flat. Though average spot rates in January are almost $6,000 higher this year than last, contract rates are a couple of dollars lower. This illustrates the fact that uncertainty over the outlook for Brazilian imports remains high in the longer term, as opposed to the current pick-up in the container market.

“Seasonally, after an uptick in January, the container market usually slows down up to the Chinese New Year, with the idle fleet rising and exports from the Far East falling as manufacturing shuts down for celebrations,” says Peter Sand, BIMCO’s Chief Shipping Analyst.

“Given the current circumstances, that would offer a great opportunity to rebalance the market and get containers to where they need to be, but this year’s celebrations will be different and are unlikely to create the usual dip in exports,” says Sand. “Looking past the Chinese New Year, the current imbalances in the market will take many months to resolve, which will continue to support the record high spot rates. However, once this immediate crisis is resolved, freight rates will fall once more, but experiences of the past year mean that carriers may find themselves able to better manage capacity and ensure profitability.”