Ships in Chinese waters are disappearing from tracking systems following the introduction of a new data law in China, frustrating efforts to ease bottlenecks that are snarling the global economy, according to three shipping sources directly impacted.China's Personal Information Protection Law, which came into effect on Nov. 1, has added to a raft of new rules designed to increase government control over how domestic and foreign organizations collect and export China's data…

While the Covid-19 pandemic resulted in few direct claims for the marine insurance sector, the impact on the welfare of crews and the boom in shipping and port congestion, exacerbated by the Ukraine invasion, raises potential safety concerns…

Decarbonization is the greatest challenge facing the shipping industry today.The effort to reduce emissions and environmental impact extends to all sectors and players and will leave no one in the industry unaffected.The IMO’s effort to decarbonise shipping is a numbers game…

During the first seven months of 2021, only three actively trading Very Large Crude Carriers (VLCCs) have been sold for demolition. The current market for seaborne transportation of crude oil is weak and has caused freight rates to drop to multi-year lows…

BIMCO’s Shipping Number of the Week: Secondhand container ship deals jump over 100% in H1 2021During the first half of 2021, a total 277 container ships have changed hands, a 103.7% jump from 136 ships bought and sold in the same period of 2020 (source: VesselsValue)…

BIMCO says the year 2021 has started strongly for the capesize market with 1,427 journeys completed or underway in the first 20 days of the year, a 10.4% increase compared to the same period last year, according to figures from VesselsValue…

According to VesselsValue, the recent events have resulted in an increasingly pessimistic short term outlook for the Tanker market, after a positive autumn and winter.'In short, factors contributing to supply growth and demand constriction have combined to bring down Tanker rates…

The Containership market has been showing some significant gains across both earnings and values, particularly in the Post Panamax and New Panamax segments, says VesselsValue.The US China trade war has had a negative impact on vessel demand…

Indonesian shipping and logistics company Pelita Samudera Shipping (PSS) has bought one bulk carrier from Singapore-based Convivial Navigation Co. Pte.Purchase price of the handysize class MV is USD7.53 million. PSS is settling 20% of the amount in cash and the remaining 80% in PSS shares…

Over recent years the United Arab Emirates has emerged as an important maritime hub with grand ambitions. Mark Venables visited the region to discover what is driving that growth.When the UAE was elected to the IMO Council as a Category B member…

Companies are leaving Britain's shipping registry due to uncertainty over Britain's departure from the European Union and future commercial arrangements with the bloc, industry officials say.All commercial ships have to be registered, or flagged…

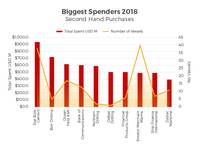

With less than a week until Christmas and most of our presents bought, we're feeling the pinch. However, that's nothing compared to the amount that some have been spending this year. VesselsValue's Senior Analyst Court Smith gives a rundown…

South Korea's largest shipping line Hyundai Merchant Marine (HMM) said it will invest 3.153 trillion won ($2.84 billion) for 20 new large containerships to be delivered by June 2021.In June this year, the company signed letters of intent for…

Tough new rules on marine fuel are forcing shipowners to explore liquefied natural gas as a cleaner alternative and ports such as Gibraltar are preparing to offer upgraded refueling facilities in the shipping industry's biggest shake-up in decades…

Thoresen Thai Agencies Public Company reported the sale of M.V. Thor Enterprise, a general cargo vessel with a rated capacity of 42,529 deadweight ton (DWT) built in 1995. The Vessel was sold to a company which is not a connected person of the Company by Thoresen Shipping Singapore…