Brazilian port operator CLI concluded the payment of 1.4 billion reais ($263.43 million) on Monday to railway company Rumo SA for control of a grain terminal in Santos port, the company said.The deal is being funded by the acquisition of a 50% stake in CLI, formally Corredor Logistica e Infraestrutura, by Australia's Macquarie infrastructure Partners from Brazilian private equity firm IG4.In an interview with Reuters…

Mazda Motor will probably have to temporarily move shipments to another port from Baltimore to avoid delays, the automaker's CEO said in a CNBC interview.The Port of Baltimore ranks first in the U.S. for volume of autos and light trucks and…

Turkish President Tayyip Erdogan will discuss a new mechanism to allow Ukrainian grain exports through the Black Sea with his Russian counterpart Vladimir Putin during his upcoming visit to Turkey, Foreign Minister Hakan Fidan said on Sunday…

Russian ports are operating during more severe storms and easing restrictions for non ice-class vessels during winter, traders said and regulations showed, in an attempt to boost exports following disruptions from Western sanctions and harsh weather…

The U.S. Department of Transportation’s Maritime Administration (MARAD) and the American Association of Port Authorities (AAPA) announced they are surveying port authorities and marine terminal operators to identify national port cargo handling needs over the next five to 10 years…

U.S. officials have begun informal talks to prepare for new negotiations on the North American Free Trade Agreement (NAFTA), David Cohen, the country's ambassador to Canada, told CBC News in an interview published Saturday.'On the U.S. side…

The Dutra Group, based in San Rafael, Calif., has been awarded a contract to perform maintenance dredging in Brooklyn, N.Y.The $9,639,000 firm-fixed-price contract was awarded by the U.S. Army Corps of Engineers New York District. Dutra was one of four bidders for the project…

San Rafael, Calif. based dredging and marine construction contractor The Dutra Group was awarded a $67,478,100 dredging contract from the U.S. Army Corps of Engineers.Under the firm-fixed-price award, Dutra will perform dredging by hopper or…

As Patrick Ryan assumes the top tech exec spot at ABS, Maritime Reporter TV interviewed him on the eve of the announcement. While shipowners face multiple technology challenges ahead, Ryan said a top priority is the bridging of technology from the fundamental phase into operational solutions…

WISTA International (Women's International Shipping and Trading Association) elected their new President, Elpi Petraki, from WISTA Hellas, at its Annual General Meeting on October 26, in Geneva, Switzerland. WISTA International consists of 56…

Peter Sand, the chief analyst of Xeneta discuss recent trends in the container shipping market, from plunging spot rates to blank sailings.The container shipping market has enjoyed a prolonged historic, and somewhat unexpected bull run, as COVID…

Germany would put its port of Hamburg at a competitive disadvantage if it quashed a bid from China's Cosco to buy a stake in a container operator, the port city's mayor said.A rejection would be 'a one-sided, competition-distorting disadvantage for Hamburg compared to Rotterdam and Antwerp…

German container shipper Hapag-Lloyd is spending billions on expanding and renewing its fleet and looking at investing in more port infrastructure to extend its edge in the post-COVID 19 world economy, chief executive Rolf Habben Jansen told Reuters…

Sudan recently signed a memorandum of understanding (MOU) with the United Arab Emirates for a large agricultural project linked by a road to a new port to be built on the Red Sea, the Sudanese Finance Minister said on Wednesday.The two sides were now working on the details of the project…

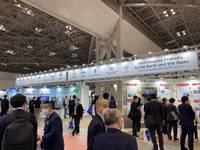

Maritime Reporter & Engineering News is back on the international exhibition trail in full force, earlier this month in Oslo for NorShipping '22 (which was a very strong and well-attended event), currently in Tokyo for Sea Japan '22 (which has garnered a strong regional draw)…