“Not only does the top of the river move, but the bottom of the river also moves.” - James Bodron, U.S. Army Corps of Engineers, Mississippi Valley Division, Regional Business Director.

Dredging was the Herculean act that allowed much of the U.S. economy to keep chugging along as usual, at least for Midwest and Central states, as drought conditions threatened to shut down river traffic on the Mississippi River and its tributaries, during fall and winter 2022 and early 2023.

The full scope of these U.S. Army Corps of Engineers’ (USACE) dredging efforts was highlighted at the December 1, 2022, meeting of the Inland Waterways Users Board, in Galveston, Texas.

James Bodron, with the Crops’ Mississippi Valley Division, summarized the USACE’s expansive work. “We have a plan to keep the river open,” Bodron explained in December.

The Mississippi Valley Division (MVD) includes six USACE Districts: St. Paul, Minn.; Rock Island, Ill.; St. Louis, Mo.; Memphis, Tenn.; Vicksburg, Miss.; and New Orleans, La.

Eight dredges were central for maintaining a 9-foot channel, focused on the Mississippi, between St. Louis and Cairo, Ill. The Corps was looking to add three more dredges, two for harbors in Memphis and Vicksburg and one for the Red and Ouachita Rivers.

In December, the Mississippi’s lowest stage was minus 10 feet. For perspective, Bodron noted similar low-flow conditions in 2012 but fewer river traffic problems in 2022. Bodron cited NOAA data that 2022 was the 15th driest year nationally.

Bodron said dustpan dredges work best on the lower Mississippi, where four were at work. He referred to dustpans as “big vacuum cleaners”. Cutterhead dredges are primarily used for harbors, he said. Demands on crews and equipment were extensive. The dustpans, in December, had already worked almost 100 days. Normal dispatch is about 45 days each year. “So, we've got twice the dredging we've already had in the lower river,” Bodron reported, “And we expected that could be up to 200 days of dredging if the low water continues.”

These intense efforts did not go unnoticed by the Users Board. Chairman W. Spencer Murphy, with Canal Barge Company, complimented and thanked the Corps: “The Corps has done a tremendous job keeping navigation channels open and finding creative ways to fund non-stop dredging operations. We never lost our ability to operate on the rivers despite record low water conditions. It’s a credit to the Corps’ proactive work to identify dredging needs and mobilize into action. For this great work, we thank the Corps, including many leaders in this room, for your help in ensuring that our inland system remains a reliable mode for moving the nation’s critical freight.”

Lisa Parker, with the MVD press office, was asked about lessons learned from the 2022 drought. She said that communication between industry and the Corps was important in order to know about shoaling problems and dredging priorities. She said social media will be used more extensively in the future.

Another lesson: equipment maintenance. Two USACE dredges – the Jadwin and Potter – are over 90 years old. Parker said maintenance was scheduled regionally to ensure that only one dredge was down at a time. This worked; MVD had no major breakdowns.

USACE dredging helped to combat historic low water levels on the United States’ inland waterway system in 2022. (Photo: USACE)

USACE dredging helped to combat historic low water levels on the United States’ inland waterway system in 2022. (Photo: USACE)

Other projects and issues

The Corps spends around $1.5 billion each year on dredging in hundreds of navigation projects across the country. The Corps is responsible for maintaining and improving nearly 12,000 miles of shallow-draft inland and intracoastal waterways, 13,000 miles of deep-draft coastal channels and 400 ports, harbors and turning basins throughout the U.S.

Top issues each year, across the industry, are presented at the USACE’s annual National Dredging Meeting, scheduled this year for May 24 in Atlanta. The meeting includes dredging leadership from government and industry, and it precedes a next-day (May 25) meeting of the Industry/Corps Hopper Dredge Management Group, a forum for representatives from hopper dredge companies and the Corps.

Kate Skelton, USACE’s Coastal Navigation Program Manager, said top issues in 2023 are safety, beneficial use of dredged material, modernizing and strengthening national waterways and “strengthening communications and relationships with our partners”. The meetings provide a chance to meet with USACE District leadership as well as Corps personnel from various offices, such as ERDC – USACE’s Engineer Research and Development Center – and contracting and cost estimating.

Beneficial use (BU) is a focus among USACE regions and across federal agencies. On the West Coast, for example, in USEPA Region 9 (Arizona, California, Hawaii, Nevada, the Pacific Islands, and 148 Tribal Nations) EPA and USACE work together on BU. Michael Brogan, with the Region 9 press office, said “(EPA’s) top focus continues to be beneficial reuse of material from navigational dredging, as opposed to wasting that material in the ocean. Beneficial reuse advances climate resiliency and is a nature-based solution as called for by the Administration.” Brogan said EPA’s aim is to “significantly increase” BU; now, just 40% of dredged material is reused in Region 9.

Money and timing are factors with BU. Hauling costs can go way up and the overall BU schedule may not align with when dredging can be done. Brogan said EPA is working with coastal states to set policies and permitting frameworks to “encourage the removal of barriers to dredged material reuse.” He added that “multiple regulatory and resource agencies operate in our region’s dredging realm, particularly in California, so close coordination on all elements is critical to make reuse happen.” Regarding environmental issues Brogan noted that “contaminants in sediments are generally not as prevalent in our region, as opposed to older industrialized harbors and areas in the East.”

Dave Deegan is with EPA’s public affairs office in New England. He too said that “although there has always been an interest in finding beneficial uses for dredged material, there is a renewed focus on this topic in 2023 at both the regional and national levels.” BU challenges arise when there are concurrent multiple, large-volume dredge projects, not just with siting but with limited shoreside handling facilities. In addition, Deegan said, dredging in older port areas raises contamination concerns.

In MVD, Parker said the Division is partnering with USACE’s Engineer Research & Development Center on BU research, seeking ways to “maximize the value of the dredging program and to better understand and predict sedimentation patterns at Southwest Pass.”

Another research focus is on innovative contracting methods such as the Regional Dredge Demonstration Project that allows early award contracts for hopper dredges in Southwest Pass and combining contracts that have similar dredging needs into a single contract. Parker said, “This allows for fewer ‘no bid busts’, a reduced cost per cubic yard, and a more efficient process of awarding contracts.”

The USACE Memphis District’s dredge Hurley in January wrapped up a record-breaking 273-day dredging season. (Photo: USACE)

The USACE Memphis District’s dredge Hurley in January wrapped up a record-breaking 273-day dredging season. (Photo: USACE)

Some private sector insights

Great Lakes Dock and Dredge (GLDD) is the largest provider of dredging services in the U.S. In May, GLDD reported its 2023 first quarter financial results. GLDD’s public filing provides insights into the industry’s challenges.

While most of its vessels were working, the total mix of projects for GLDD was less profitable than in the first quarter of 2022. Weather delayed projects in the Northeast.

GLDD’s total first quarter 2023 bid market is over $300 million, about $125 million higher than a year earlier. Port deepening and widening projects, delayed in 2022, are now restarting.

Big projects are on the horizon, e.g., the $160 million Freeport Capital Port Deepening project. GLDD is keeping an eye on liquified natural gas projects that will require dredging likely in the second half of 2023. GLDD notes that several North American liquefied natural gas (LNG) export projects were delayed during the pandemic. However, the company comments that “with the increase in LNG prices, some of these LNG projects are currently gaining momentum and are targeting final investment decisions in 2023.”

GLDD adds further that “we expect that improved market conditions, combined with the fleet adjustment and cost reduction initiatives, will provide improved results in 2023 and beyond.”

GLDD references that a number of public policy developments are important for the dredging industry. For example, GLDD is active in offshore wind work. The company is constructing the Acadia, a fallpipe vessel for subsea rock installation, expected to be delivered in the first half of 2025. In 2022, GLDD was awarded rock installation contracts for the Empire Wind I and II projects by Equinor and BP, with installation windows in 2025 and 2026. The company is bidding additional offshore wind farm projects with rock installations planned for 2025 and beyond.

In a market update section, GLDD notes continued strong support for dredging from the Biden Administration and Congress. The company highlights funding from the following:

GLDD concludes that “This increased budget and additional funding support our expectation for a stronger bid market in 2023.”

The American Association of Port Authorities (AAPA) is a trade organization that works to keep its members timely and connected with USACE’s dredging policies and coastal navigation mission. Jen Armstrong is AAPA’s Director of Navigation Policy and Legislation. In a recent article for AAPA’s Seaports newsletter, Armstrong suggested ways that could improve federal budget processes that impact large engineering projects, such as USACE’s projects that can be negatively impacted because they depend on annual appropriations and on a project-by-project basis.

Armstrong suggests the need to develop a national coastal navigation strategy.

“The volume of ongoing studies and projects in the design phase is a bellwether for forecasting future construction needs,” Armstrong writes. She suggests that to prepare for the next project wave, industry and government leadership should work now to tackle funding and budgeting problems head-on. It’s important to keep in mind that projects often involve a number of major partners, all of whom need to contribute to the total cost and within coordinated schedules. Armstrong writes that, indeed, a comprehensive strategic plan that identifies and optimizes cost savings would complement requirements in the National Defense Authorization Act which directs that the national maritime strategy is updated every five years. “Developing a comprehensive strategy for coastal navigation funding is a no-brainer,” Armstrong concludes.

Using AI to Improve Dredging Operations

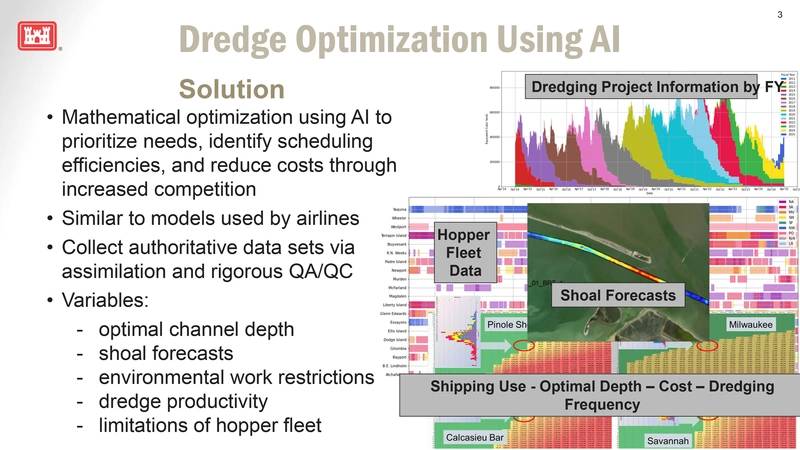

Dredging is the largest individual item in the USACE civil works budget. Now, Corps researchers are using artificial intelligence (AI) and operations research methods to help prioritize and schedule dredging operations. This new work was presented in a July 2022 report by Carol Coleman at ACE’s Engineer Research and Development Center (ERDC).

“These models are not about dredging operations,” said Dr. Ned Mitchell, an ERDC researcher cited in the report. “This is not about how to dredge,” he added, “it is more about how to manage the dredging program, both from a budgetary standpoint and a scheduling standpoint.”

(Image: USACE)

(Image: USACE)

The new modeling provides answers regarding priority locations, the extent of dredging required, frequency and the best sequencing of work and how to draw the highest number of competitive bids. The result is more cost-effective spending, perhaps saving as much as $100 million/year, money that could go to smaller projects that usually don’t get funded.

In an update report titled “Dredge Optimization Using AI” USACE cites ongoing work and some initial successes. (See illustration) including:

This effort is saving money: $3.7 million at Mobile harbor, for example. And there are operational efficiencies, in the Gulf Region, for example, rotating contracts allow for work assignments anywhere to address emergency shoaling needs.

Dredging: still hard work. But now working smarter.