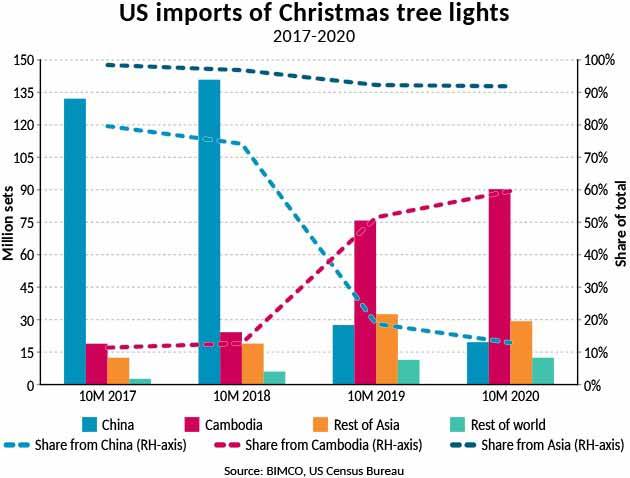

During the first 10 months of the year, the US has imported a total of 151.4 million sets of Christmas tree lights to decorate their homes this holiday season. Although that represents a 3% rise compared with the same period last year, the figure fails to match the record 189.9 million Christmas tree lighting sets that were imported during the first ten months of 2018.

BIMCO has closely followed US imports of Christmas tree lights since tariffs were imposed on imports of these from China in September 2018, which has caused dramatic change.

Compared to the first ten months of 2017, Christmas lights imports from China have dropped 85.2%, from 132 million sets to just 19.6 million. This means the share of Christmas tree lighting sets imported by the US from China has dropped from 79.6% to 12.9% of total lighting set imports. However, the share of the imports from the whole of Asia has remained more stable and still stands at 91.8% in 2020, as other Asian countries, Cambodia in particular, have grown their exports of Christmas tree lights.

US imports of Christmas tree lights from Cambodia have jumped by 378.2% in the first ten months of 2020 compared with the same period in 2017, from 18.9 million sets to 90.4 million, with its share of total imports rising to 59.6% from 11.4%. Also, other Asian countries have increased their exports of Christmas tree lights to the US, more than doubling their combined share from 12.4 million to 29.3 million sets in 2020.

“The change in US imports of Christmas tree lights clearly show the result of the trade war on the goods affected, as well as the shift in manufacturing patterns that has occurred within Asia, as US importers seek to avoid paying extra tariffs on goods from China. Despite this, the Chinese trade surplus with the US rose to its highest level on record in November,” says Peter Sand, BIMCO’s Chief Shipping Analyst.

“The fact that much of the manufacturing has remained in Asia means that demand for container shipping has not been as badly hit as what was feared when the trade war began.”